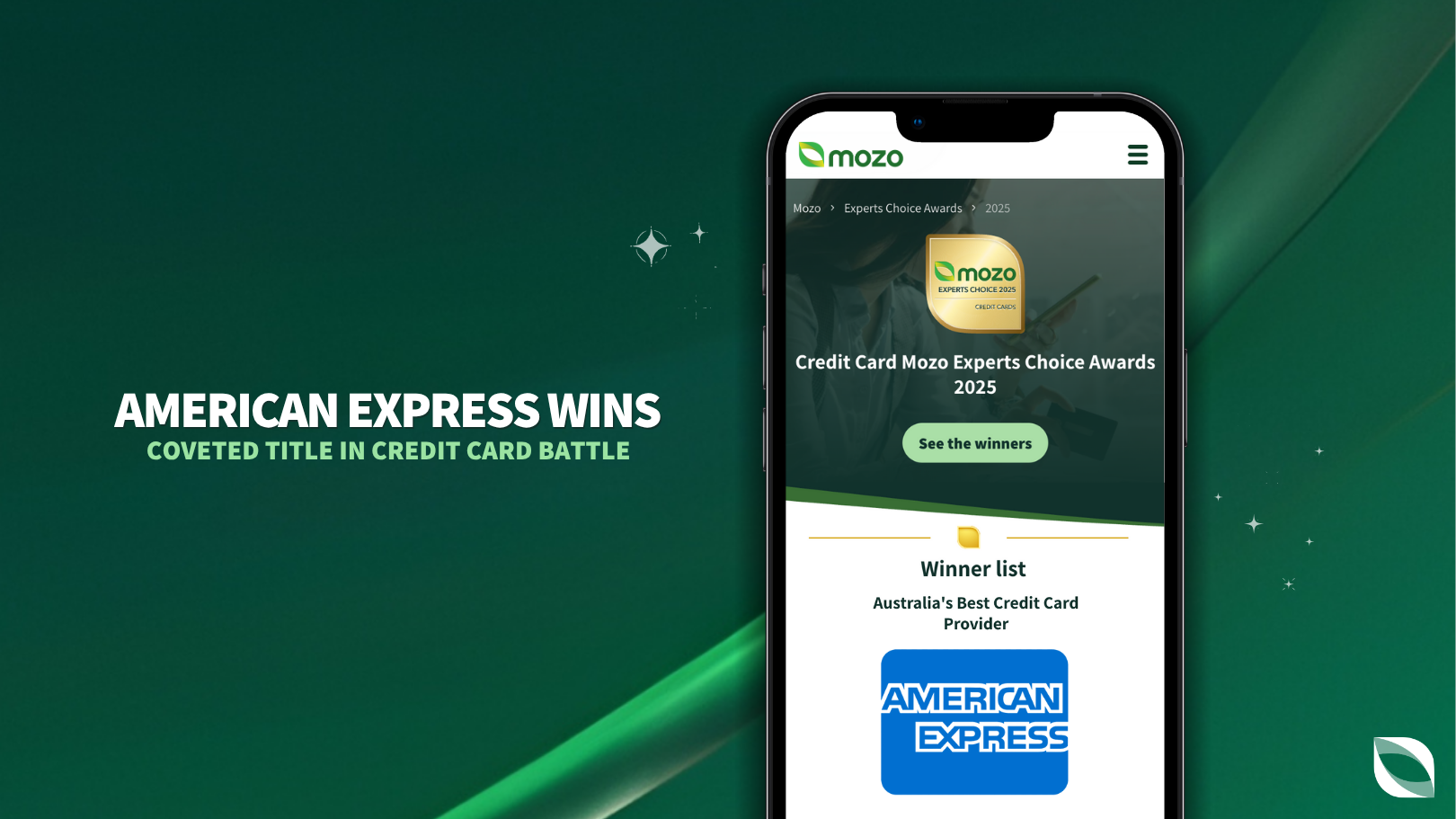

American Express wins coveted title in head-to-head credit card battle

Credit card heavyweight American Express has dominated the 2025 Mozo Experts Choice Credit Card Awards^, scooping up awards across multiple categories and scoring the coveted title of Australia’s Best Credit Card Provider .

American Express won an impressive 11 awards, making it the most successful of the 63 credit card issuers that were assessed head-to-head as part of the annual awards process.

“American Express was once again a standout this year, sweeping up more Mozo Experts Choice Awards than any other credit card provider,” said Mozo Awards Judge, Peter Marshall.

RELATED: Compare Best Credit Card Deals

Predictably, AMEX performed well in the multiple rewards credit card categories.

“American Express continued to live up to its reputation as the destination for generous customer perks, shining in all of the rewards, frequent flyer and premium rewards categories.

“While the company is synonymous with rewards credit cards, what might be surprising is that the Low Rate Credit Card also ranked among the top No Annual Fee cards in the market according to our analysis,” said Marshall.

American Express wasn’t the only provider to take out awards in multiple categories. Be sure to check out the full list of 2025 Mozo Experts Choice Credit Card Award winners or head over to our hub and compare top credit card deals this month.