Mozo Money Moves: Savings rate cuts, AI trading insights, why term deposits may be ideal for Gen Z, and the top travel picks for Aussies in 2025

Welcome to Mozo Money Moves , your weekly round-up of what’s moving your money and shaping your financial decisions. With travel back on the agenda, this week we're kicking off by revealing the top travel destinations of 2025. We'll also dive into the future of investing with a look at AI trading, a growing trend that comes with a few key lessons for Australian investors. Finally, we'll explore why a generation often stereotyped as digital-first could turn to the humble term deposit, plus a breakdown of the banks that have cut savings rates.

Banks keep cutting savings rates after RBA decision

Reserve Bank of Australia’s (RBA) cash rate cut earlier this month, the struggle for savers has continued, with banks across the board lowering their interest rates on savings accounts . This trend is a clear indication that what's good for borrowers is bad news for those looking to grow their nest egg, as lenders are often quick to pass on rate cuts to savers while delaying the reductions for borrowers. This makes it more important than ever for savers to be vigilant and shop around for the best possible rate.

ING Savings Maximiser vs Savings Accelerator

Mozo recently kicked off a new series of head‑to‑head comparisons , pitting financial products against each other. This week’s side-by-side ‘versus’ showdown features savings accounts.

For customers of ING, post-RBA rate changes raise the question: which savings account is right for me? Mozo has put the bank's two key offerings, the Savings Maximiser and the Savings Accelerator , to the test.

| Feature | ING Savings Maximiser | ING Savings Accelerator |

|---|---|---|

|

Max Rate (p.a.)

|

4.80% p.a. (for balances up to $100,000)

|

Up to 4.70% p.a. (for balances $150,000 to $500,000)

|

|

Base Rate (p.a.)

|

0.05% p.a.

|

Tiered: 2.10% for <$50k; 3.00% for $50k-$150k; 3.95% for $150k-$5m

|

|

Eligibility

|

Must deposit $1,000 from an external source, make 5+ card purchases, and grow balance monthly

|

No monthly deposit or transaction requirements

|

Source: Mozo database . Information accurate as at 22 August, 2025.

The key difference lies in their conditions. The Savings Maximiser offers a strong headline rate, but it is conditional on the customer meeting three monthly criteria: depositing at least $1,000 from an external source, making five or more eligible card purchases, and growing the account's balance each month. If these conditions aren't met, the rate drops to a virtually non-existent standard rate (0.05% p.a.).

In contrast, the Savings Accelerator has no monthly conditions to meet, with its tiered rates applying automatically based on your balance. However, the highest rate is an introductory offer for new ING savings customers, which reverts to a lower variable ongoing rate after four months.

While the Savings Maximiser can offer a higher return for balances up to $100,000, it requires discipline to meet the monthly requirements. The Savings Accelerator offers a simpler, more set-and-forget approach for those who may not be able to meet the strict conditions of its counterpart.

Consumer confidence surges as spending shifts up

Australia's spending slowdown may be turning a corner, with household spending finally showing signs of recovery after a sluggish few years. According to CBA economists , a "real income shock" from high inflation, rising interest rates, and tax pressures had previously squeezed household budgets, leading many to cut back on spending or prioritise saving and debt repayment.

However, the tide is now turning. The latest Westpac-Melbourne Institute Consumer Sentiment Index for August shows a 5.7% surge, pushing it to its highest level in three and a half years. This positive shift was broad-based, with all six states recording a gain.

CBA's analysis backs this up, with their Household Spending Insights recording a 6.4% annual growth in July and ten consecutive months of gains. The recovery is being led by discretionary spending, particularly from younger Australians aged 20-34, while older Australians remain more cautious.

This improving sentiment, particularly among home buyers , suggests that the RBA's ongoing interest rate cuts and improving incomes are having a tangible impact on how Australians feel about their financial future. This is a hopeful sign that the financial pain of the last few years may be easing, with economists expecting momentum to build into 2026.

CBA cuts fixed rates by up to 0.45% p.a.

The Commonwealth Bank of Australia (CBA) has announced a significant reduction in its fixed home loan interest rates for new customers, with cuts of up to 0.45% p.a. effective today.

The move aligns with the bank's previously announced 0.25% p.a. cut to its variable home loan rates. As part of the changes, CBA's new lowest variable rate for owner-occupied home loans is now 5.34% p.a. (5.47% p.a. comparison rate*), available on its Digi Home Loan.

The most notable fixed rate changes for principal and interest owner-occupied loans include a 0.30% p.a. reduction for a 2-year term and a 0.35% p.a. cut for a 5-year term. For investment loans, the largest cut was 0.35% p.a. for a 1-year fixed rate and a 0.30% p.a. reduction for both the 2-year and 3-year terms.

The bank also made substantial reductions to its interest-only fixed rates, with the biggest cut being 0.45% p.a. for a 2-year fixed investment loan.

The lowest available fixed rate from CommBank is 5.34% p.a. (7.13% p.a. comparison rate*) for a 3 year fixed home loan with the Wealth Package. However, it’s important to note that we’re seeing more fixed rate loans under 5% p.a. since the RBA’s latest rate cut.

*WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.The comparison rate displayed is for a secured loan with monthly principal and interest repayments for $150,000 over 25 years.

Why term deposits could be a smart move for Gen Z

For a generation often stereotyped as digital-first and fixated on volatile investments like crypto, Gen Z may be inclined to consider the humble term deposit . Just 7% of Australians aged 18-29 hold a term deposit, compared to nearly one-third of those over 65. However, in a rate-cutting cycle , the features of a term deposit are proving to be a powerful tool for young savers.

Term deposits can offer:

- Guaranteed returns. Unlike high-interest savings accounts with variable rates that are now falling, a term deposit allows you to lock in a fixed rate and a guaranteed return for a set period, providing certainty and stability for your savings.

- Security. As your principal and interest are guaranteed and not subject to market fluctuations, term deposits are an incredibly safe investment. For a young person saving for a major goal like a home deposit, this is a major advantage.

- A ‘set and forget’ mentality. The disciplined nature of a term deposit can help savers stay on track towards their goals, as the money is not easily accessible.

Young Aussies don’t have to stick to an all-or-nothing strategy. A term deposit laddering approach , where you split your savings across multiple term deposits with staggered maturity dates, can provide regular access to funds while still securing fixed rates. Sticking with a major bank isn't always the best move either, with smaller banks and credit unions often offering more competitive rates.

Top 10 travel destinations among Aussies in 2025

For Australians planning their next big adventure, Mozo has covered a list of the top ten travel destinations for 2025 . The list was put together by analysing a combination of Australian Bureau of Statistics (ABS) search data and affordability, offering a mix of popular hotspots and emerging travel destinations.

Here are five of the top destinations for your consideration:

- Japan. The land of the rising sun continues to grow in popularity among Australians seeking a blend of cultural experiences and modern city life.

- Thailand. A perennial favourite, Thailand remains a wondrous, exciting and budget-friendly option for Aussie travellers.

- Indonesia. Bali draws in tourists with its affordable prices, close proximity to mainland Australia, relaxed lifestyle and cultural attractions.

- New Zealand. The closest international destination for many Aussies remains a top choice, with spectacular mountains to climb, ski and board, adventure sports galore and exceptional cuisine.

- United Kingdom. Despite higher than average hotel costs, the UK continues to be a popular destination for Australian travellers.

AI trading: insights every investor should know in 2025

While AI-powered trading is a fast-growing trend, it comes with risks that investors should be aware of. The technology can analyse vast amounts of market data and execute trades at high speed, but it's not a foolproof path to riches.

Here are five key lessons for Australian investors to consider:

- AI isn't foolproof. AI models are only as good as the data they're trained on and can fail to account for unexpected market events, known as "black swan" events.

- Risk management is key. AI can amplify both gains and losses. Investors must have robust risk management strategies in place to protect their portfolios from sudden market shifts.

- Human oversight is essential. AI is a tool, not a replacement for human judgment. Investors should use AI to supplement their decision-making, not surrender all control.

- Security risks are real. The growing use of AI in trading has made platforms a more attractive target for hackers, making strong security measures a must.

- Always do your research. No matter how sophisticated the technology, investors must understand the underlying assets and strategies. A responsible investor knows the "why" behind the trade, not just the "what."

These lessons highlight how AI can be a powerful tool but it's important to realise that it’s not a magic bullet and should be approached with a healthy dose of caution and education.

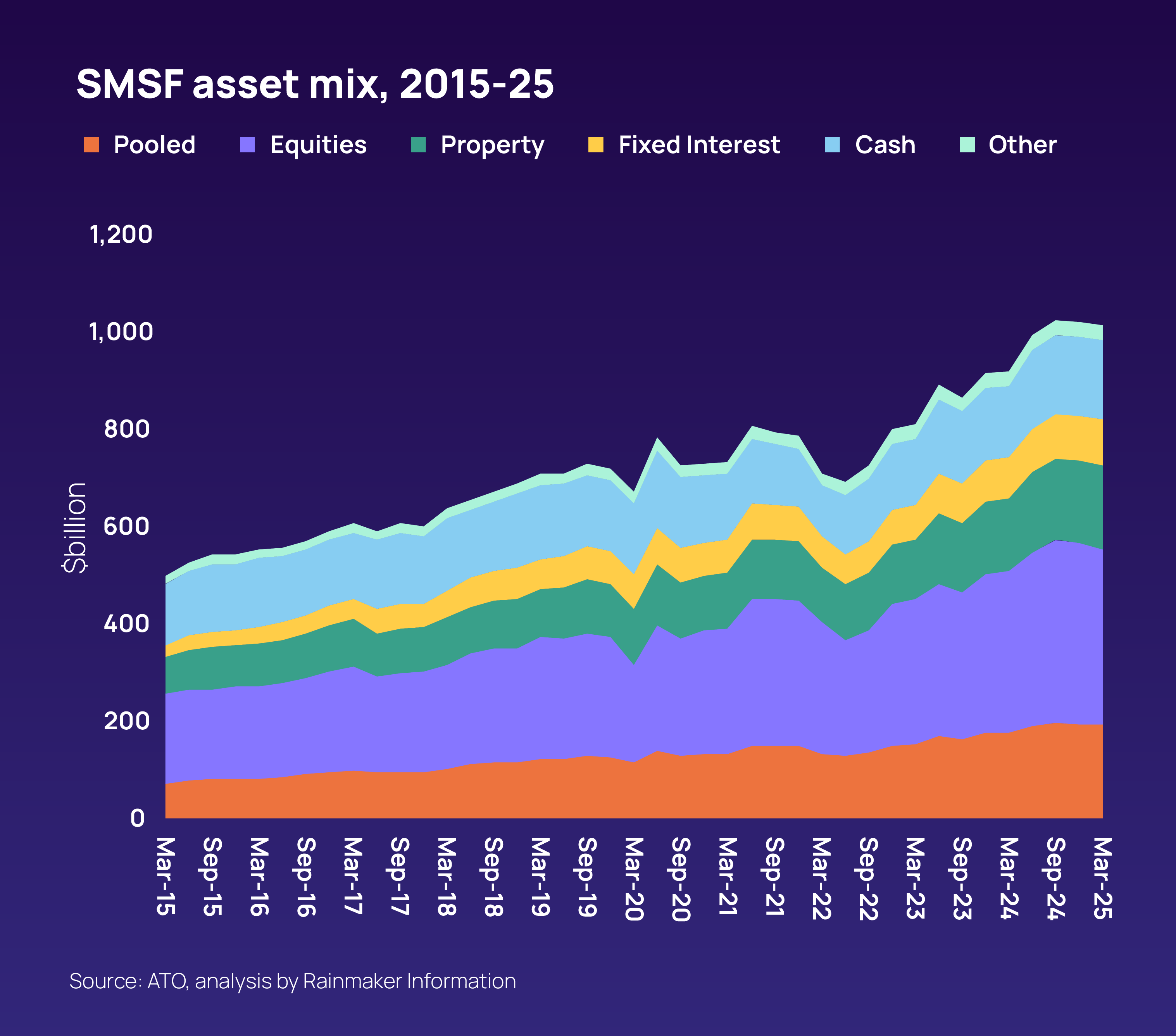

Superannuation: SMSFs shift to fixed interest and cash

A new report from Rainmaker Information reveals that self-managed super funds (SMSFs) are increasingly moving away from equities and into more conservative investments like fixed interest and cash. The allocation to fixed interest has doubled over the past decade, from 4.5% in 2015 to 9% in 2025.

This shift comes despite the diminished returns offered by fixed interest assets, which have returned just 2.3% per annum over the last ten years. According to the report, SMSFs have also been repositioning their portfolios towards pooled investments, which have increased their allocation from 13% to 18%. Conversely, their allocation to cash has plummeted from nearly one-third of all investments in 2013 to just 16% in 2025.

While equities remain the largest asset class for SMSFs at 36% in 2025, their allocation has remained stable over the past decade, and the growth in fixed interest and pooled investments suggests a move towards a more diversified and potentially more cautious investment strategy. This trend highlights the growing sophistication of SMSF investors in an ever-competitive superannuation landscape.