How do I redeem credit card rewards points?

Have you been stacking up credit card reward points throughout the pandemic? Are you lost when it comes to getting the most bang for your rewards buck? Well, that’s where this guide comes in.

Have you been stacking up credit card reward points throughout the pandemic? Are you lost when it comes to getting the most bang for your rewards buck? Well, that’s where this guide comes in.

If you’re tossing up between a rewards card and a regular piece of plastic, then you might be wondering just what the benefits of having points earning power in your corner are.

You don’t have to be a mathematician when it comes to calculating rewards points. While it can be confusing as no reward program is the same, there is a fairly simple equation you can follow that will calculate the rewards points currency. This guide will hopefully help you make sense, the process of calculating rewards points so you can earn your free ticket to Bali in no time.

Choosing a credit card is a challenge in itself then deciding on the best rewards program to attach to your card can be just as testing. You may just throw your hands in the air and declare it all too difficult! But don’t, stop there and take a breath, as Mozo has come to the rescue. This guide will help you through the process of choosing a rewards program that is the best fit for you and one that will having you reaping in the benefits.

.jpg)

On the hunt for a credit card that’s going to reward you for spending? If so, you’re in the right spot! This guide will take you through all the different types of rewards credit cards you can choose from. With so many reward card options out there, find one that you will benefit from most, with perks to suit your lifestyle and needs.

Who doesn’t love something for nothing?! Well, welcome to the world of reward credit cards, your ticket to receiving freebies for spending money. There are so many types of reward programs from frequent flyer, cashback rewards, travel, and shopping rewards just to name a few.

The countdown is on. Black Friday 2025 lands on 28 November, and millions of Australians are gearing up to spend big. For some, it’s an exciting start to the holiday season. For others, it can feel like a high-pressure dash that leaves them stressed and overspending.

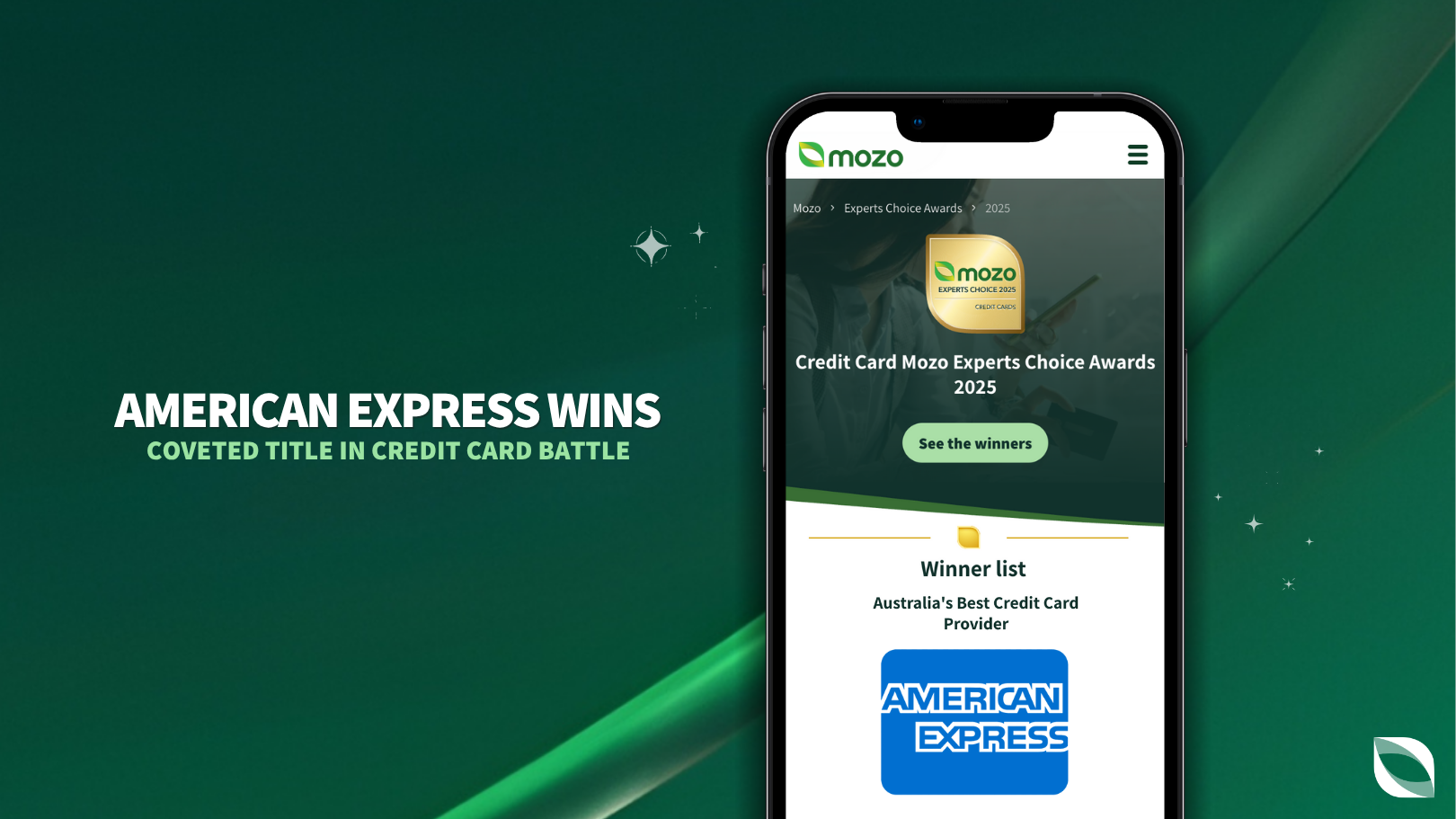

Credit card heavyweight American Express has dominated the 2025 Mozo Experts Choice Credit Card Awards^, scooping up awards across multiple categories and scoring the coveted title of Australia’s Best Credit Card Provider.

This May, more than 55,000 cafes, bars, pubs and restaurants across the capital cities of Melbourne, Sydney, Brisbane, Adelaide, Perth, and Canberra are taking part in the 2025 American Express delicious. Month Out festival.

If your New Year’s resolution involves more financial freedom, then paying off your debts is an excellent place to start. After all, we only want to take the lessons we’ve learnt into the new year, not our credit card balances.