No surprise why 3 in 5 renters can’t save for a home

The majority of Australian renters have all but given up on saving for a house deposit, for reasons that should surprise no one.

According to a Mozo survey of over 1,200 renters, 3 in 5 say they are not currently saving a deposit, of which 70% cite affordability issues, like being single (34%) or not getting paid enough (36%).

On the other hand, 1 in 5 (20%) say they’d rather rent than buy a property. In fact, this was the third most common reason listed by renters of all ages who aren’t saving for a home loan .

By comparing the price growth of rentals and properties to wages in Australia we can start to unpack why so many Aussie renters can’t afford to save.

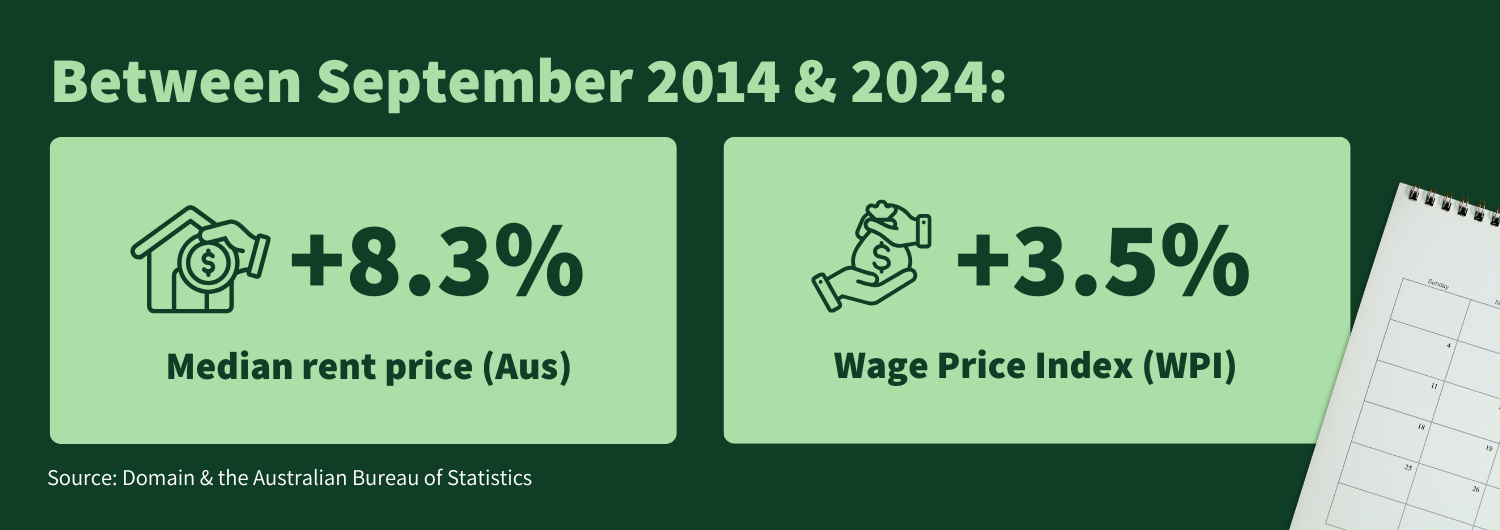

Rental price growth outpaces wage growth

The median rent in Australia’s capital cities for a house is currently $650 per week ($2,600/month), which grew 8.3% over the year to September 2024.

Wages only grew 3.5% over the same period, according to the Australian Bureau of Statistics (ABS), with median weekly earnings at $1,396 – barely double the median weekly rent.

This puts a lot of renters on the back foot when it comes to saving.

According to the survey, 16% of renters are saving less than $200 per month, 10% are saving between $200 to $500 per month, and 6% are saving between $500 to $1,000 per month.

.png)

Mortgage growth laps wages over the decade

Aside from covering rent payments, those saving for a deposit also have to contend with rising house prices and, consequently, larger mortgages.

The average mortgage size in Australia is $642,121, according to the ABS, a figure which has grown by 74% over the last decade.

Meanwhile, analysis of the ABS’ Wage Price Index (WPI) puts real wage growth over the same period at just 5.88%†.

And while you can’t always rely on historical norms, house prices in Australia are likely to continue rising.

According to the ABS, the average Australian home price in the September Quarter of 2024 was $985,900. This is a 6.5% increase from the previous year and places the average deposit size at $197,180.

For someone saving $1,000 a month, it would take them almost 16.5 years to save up the average house deposit.

Saving for a house while renting is possible

As a renter, those numbers look daunting. However, with some planning and determination, it’s entirely possible to save for a home while renting.

Here are some tips to help you leave the landlord behind and secure the keys to your own castle:

1. Check your eligibility for first home buyer schemes

First home buyer schemes can help eligible first-time buyers purchase a place without saving up a full 20% deposit or paying lenders mortgage insurance (LMI).

Check out our comprehensive list of home loan grants and schemes.

2. Opt to pay lenders mortgage insurance

If you aren’t eligible for a homeowner scheme, opting to pay lenders mortgage insurance (LMI) means you could qualify for a home loan with a deposit of less than 20%.

Just be aware that LMI can cost between 1-5% of your loan amount and that low deposit home loans usually come with slightly higher interest rates to account for the extra risk taken on by the bank.

3. Keep your savings out of reach

Remove the temptation to dip into your deposit money by opening up a high interest savings account with another bank, or locking away what you’ve already saved in a term deposit .

4. Slash your expenses

Take stock of your recurring expenses, like insurance premiums, subscriptions, and utility, phone, and internet bills. Then, take the time to compare each one to see if you can switch and save. This is also a good time to create a budget .

5. Increase your income

It’s easier said than done, but finding ways to increase the amount of money you bring in can really boost the amount you’re able to save. Whether it’s requesting a pay increase at work, flipping vintage clothes, or trying your hand at the gig-economy, this extra income can go straight towards your house deposit.

6. Pay down as much debt as possible

If you have credit card debt or an existing loan, work towards paying those off. There’s both a short and long term benefit to wiping your debts when it comes to buying a home. Not only can you put a stop to compounding interest payments, but when you do come to apply for a home loan, your credit score will be healthier and your borrowing power stronger.

7. Get a roommate

Plenty of people prefer to live alone, but having someone else to split the rent with can make a huge difference to how much you’re able to save. If you’ve got a two-bedroom apartment, for example, you could turn your home office back into a room and list it on sites like Flatmates, or in Facebook groups for your local area.

Paying half your usual rent means you can pocket the rest.

8. Find a cheaper rental

Everyone knows that moving sucks. But if rent is your biggest expense, the short term pain of finding a new place could prove to be a long term gain. Options include downsizing from a house to an apartment or moving in with other people.

Once you’ve saved up your deposit, it’s time to start searching for a home loan. Read our guide to getting a home loan to find out your next moves.

†Cumulative nominal wage growth (29.7%) was calculated using Australian Bureau of Statistics (ABS) Wage Price Index (WPI) data from September 2014 to September 2024. Adjusting for a cumulative inflation rate of 22.5% over the same period, the real wage growth was determined to be approximately 5.88%.