How to avoid fees when spending overseas

Is the countdown finally on until your next getaway? Have you been stuffing every spare banknote into your piggy bank until it could burst at any moment?

Is the countdown finally on until your next getaway? Have you been stuffing every spare banknote into your piggy bank until it could burst at any moment?

Holidaying overseas is a huge part of the Australian way of life, with thousands of keen travellers jet-setting across the world every day.

Travelling is one of life’s greatest joys. You get to explore every nook and cranny of a totally fresh destination, experience new cultures and of course form fond memories that will last a lifetime. But your dream holiday can quickly turn into a nightmare if your hard-earned holiday funds are stolen or you find yourself the victim of identity theft.

Planning a big overseas holiday? Whether it be a trail-heavy adventure of the Andes or a soothing two-week stay at a resort in Sumatra, you’re going to need a few things ticked off your travel checklist before you leave Australian shores.

While many credit card travel insurances have some great features, it's still important to read the fine print to make sure that your credit card has the right coverage for the adventure you're planning.

Almost as exciting as booking your idyllic holiday, high-flyer biz trip or irritatingly long stay in some exotic location is the exciting world of currency conversion. Hold on to your hats, as Mozo cruises through the four basic ways to spend money overseas.

Nothing can obliterate a post-holiday glow like discovering the damage you've done on your credit card. But with a few simple strategies, you might come back pleasantly surprised instead of suffering a cash-related comedown.

Arm yourself against excessive international fees, skimming, and the aftermath of card theft with our pre-holiday checklist.

A couple of months ago, we gave you the lowdown on Australia Post’s Load & Go Visa Prepaid – our national postie’s first Visa card. We were impressed with its novel prepaid approach which allowed people to enjoy all the benefits of Visa’s worldwide network, without having to go through the fussy sign-up process normally associated with credit cards. However, we found its lack of travel money features disappointing, which made the Load & Go an expensive choice for travellers wishing to make purchases in currencies other than Aussie dollars.

The latest news on travel credit cards, pre-paid cards and foreign exchange from the Mozo newsdesk.

If you’re gearing up for overseas travel, adding a cost effective payment method to your itinerary is essential.

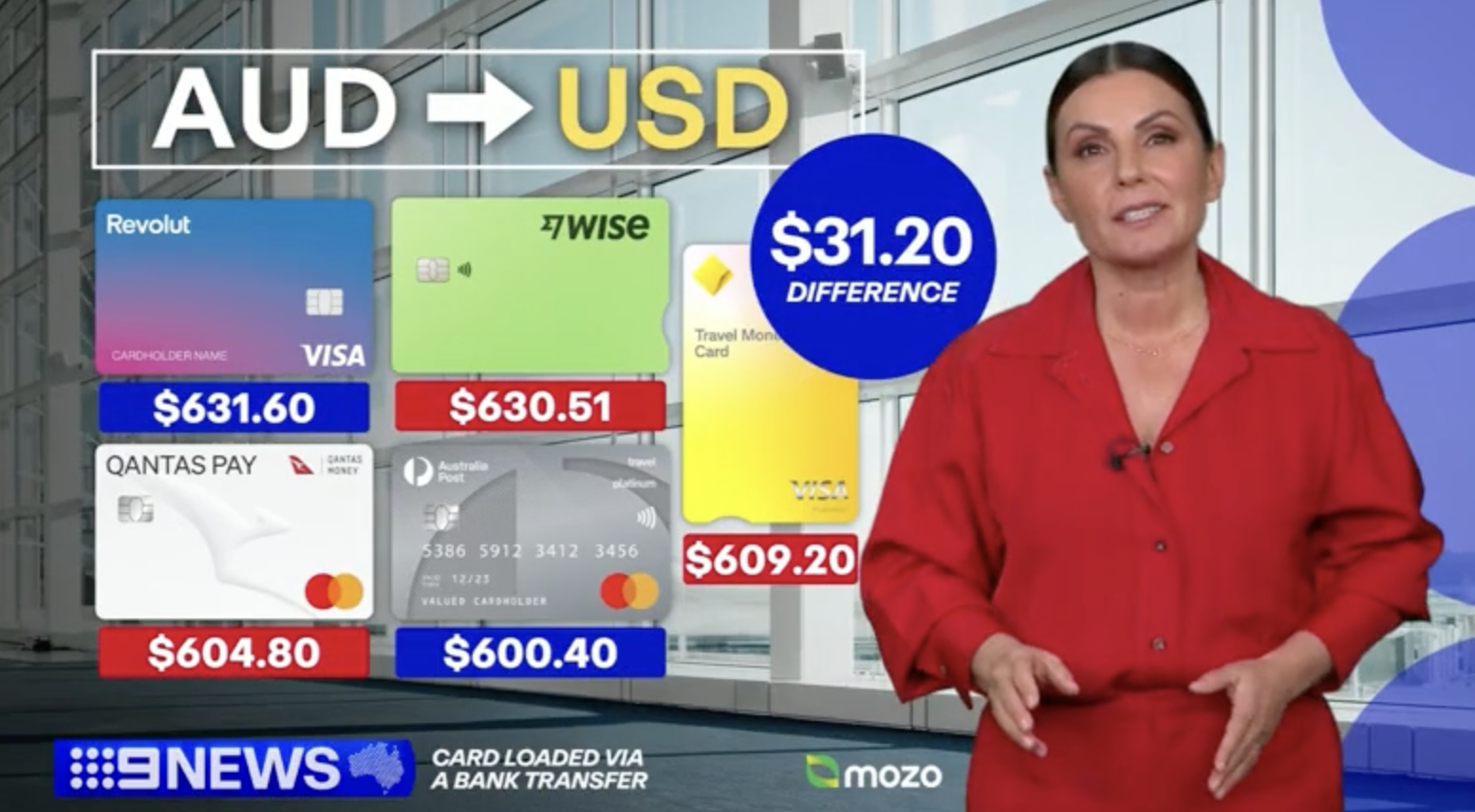

New research from Mozo has revealed that travel money cards marketed as “fee-free” may not always offer the best value. In fact, some cards that charge fees actually deliver a stronger return once exchange rates are taken into account.

Well, you’re in luck because we’ve just announced the winners of the 2023 Mozo Experts Choice Travel Money Awards. Each year, our team of Mozo Expert judges analyse prepaid travel cards to find which are the cream of the crop.

Travelling with someone is the ultimate relationship test. Can you split bills, follow an itinerary, and reach your destination – while still liking each other?