Why “Fee-Free” Travel Cards could end up costing more

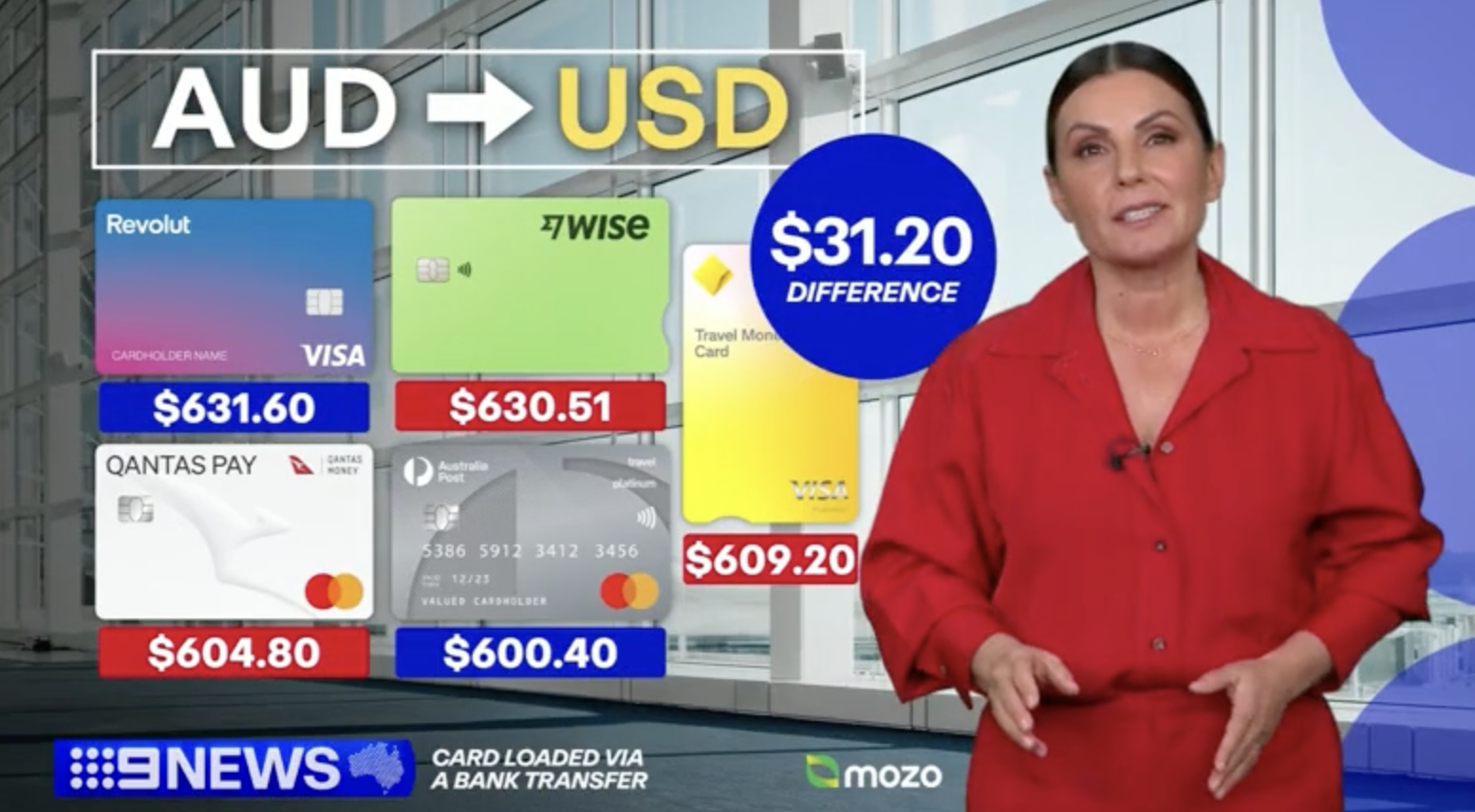

New research from Mozo has revealed that travel money cards marketed as “fee-free” may not always offer the best value. In fact, some cards that charge fees actually deliver a stronger return once exchange rates are taken into account.