Ubank takes the reins of neobank 86 400, reveals new look and products

Ubank, an Australian direct bank owned by National Australia Bank (NAB), today unveiled a new look following their absorption of neobank 86 400.

The merger comes after ubank announced intentions to acquire 86 400 in January 2021 for $220 million, with regulatory approvals received almost one year ago to the day.

Ubank’s new logo may carry a touch of nostalgia for those familiar with 86 400’s sans-serif simplicity. But the identity isn’t the only piece of 86 400 that ubank has adopted.

According to a NAB media release from 2021, they planned to use the acquisition of 86 400 to “accelerate the growth of its digital bank, ubank, by combining ubank’s established customer base and name with 86 400’s technology and innovation capability.”

Ubank will take over 86 400’s products, including bank accounts, savings accounts, and home loans.

For those with existing ubank products like USave and USpend accounts, and UHomeLoans, ubank’s online banking portal and the ubank app will still be available and work much in the same way, according to their website .

Ubank will continue to operate as a digital bank, meaning that they won’t have physical branches or ATMs. Instead they’re focussed on providing customers with “an entire bank in their mobile”.

This circumvents some of the hurdles that usually come with bank mergers - like branch closures or ATM availability issues - which should come as good news for customers of both financial institutions.

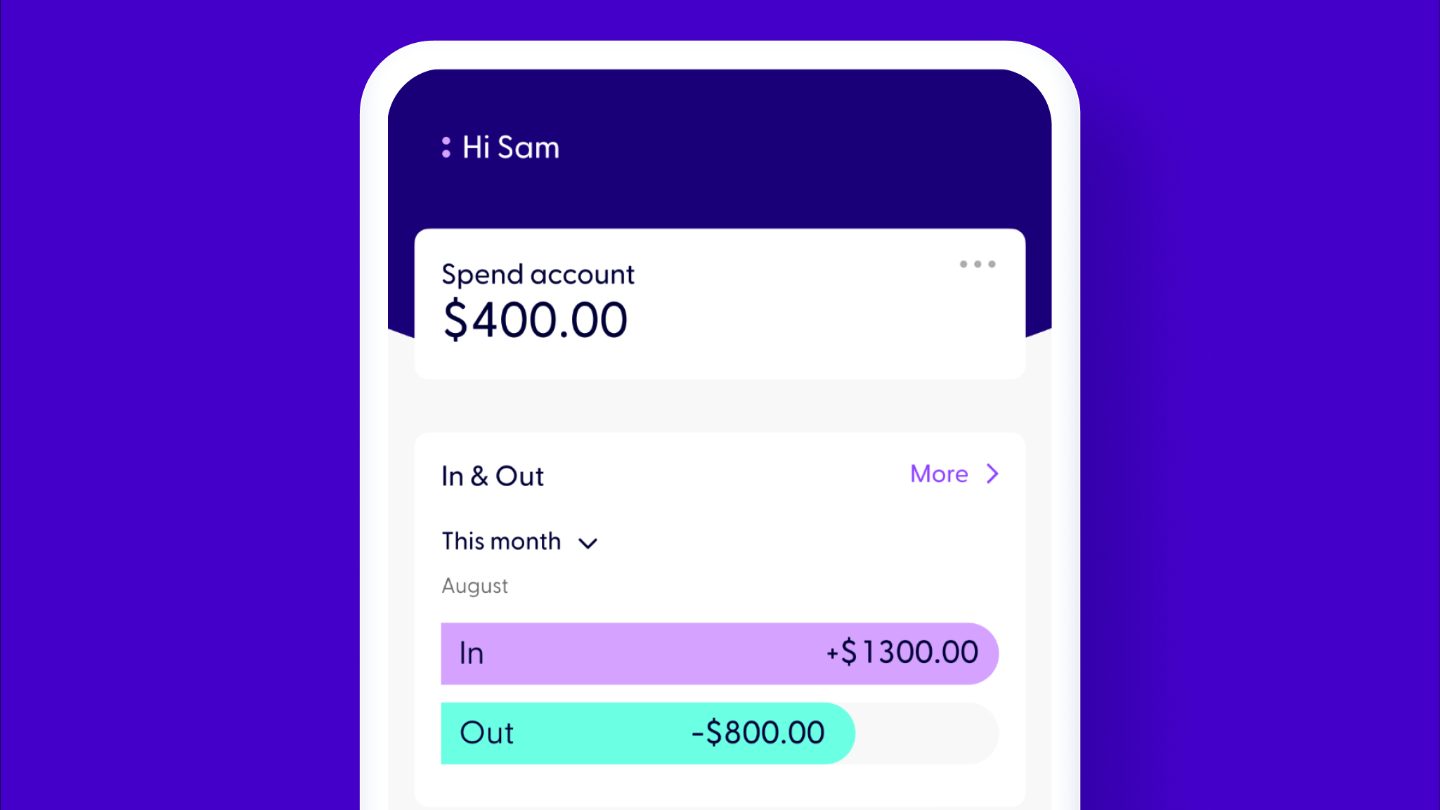

With their rebranding also comes a new-look app – an updated version of the original 86 400 app with the new ubank colour scheme and name.

Ubank is touting an in-app, two minute sign-up time for their Spend and Save accounts, access to payment features across a range of smart devices (like Fitbit Pay and Apple Pay), shared accounts with your partner, banking insights, connected accounts from other financial institutions, among more in-app features.

What products does ubank offer?

Neat Home Loan

- Variable rates from 3.14% p.a. (3.16% p.a. comparison rate*) for <60% LVR

- No service fees

- Free extra repayments and redraws

The Neat Home Loan offers variable rates from 3.14% p.a. (3.16% p.a. comparison rate*) for borrowers with an LVR of <60%. While there is no offset account, borrowers can save on interest over the life of their loan by making free extra repayments. Some of their fees include a $250 settlement fee, $300 discharge fee.

Own Home Loan (Fixed)

- 4.69% p.a. (3.78% p.a. comparison rate*) 1-year fixed

- Rate lock feature

- Open multiple offset account

For borrowers who want more certainty around monthly repayments, the Own Home Loan (Fixed) warrants a look. Fixed rates start at 4.69% p.a. (3.78% p.a. comparison rate*, with a 60% revert variable rate) on 1-year terms, and borrowers will be able to make up to $20,000 in extra repayments over the term. You can also access a redraw facility if you feel that money would be better served back in your pocket down the track. Some of their fees include a $250 yearly service fee, $250 settlement fee, $300 discharge fee.

Own Home Loan

- Variable rates from 3.49% p.a. (3.76% p.a. comparison rate*) for 80% LVR

- Free extra repayments and redraws

- Offset account available

The Own Home Loan offers competitive variable rates from 3.49% p.a. (3.76% p.a. comparison rate*) for borrowers with an LVR of <60%. There are also a number of handy features to help you save on interest, such as the ability to access an offset account and make free extra repayments. A redraw facility is also available in case you want to retrieve those extra funds. Some of their fees include a $250 yearly service fee, $250 settlement fee, $300 discharge fee.

Save Account

ubank’s Save Account is a 2022 Mozo Experts Choice Award winner for the third year running. With its impressive maximum savings rate of 2.35% p.a. (for those diligent savers who store away at least $200 per month), no monthly account fees, and the option to open up to ten Save Accounts, it’s no wonder why ubank continues to take out Mozo Experts Choice Bank Account and Savings Awards in the best Regular Saver category.

Spend Account

- No monthly account fee

- Multiple payment options

- Zero foreign transaction and ATM withdrawal fees

ubank’s Spend Account comes free of monthly account fees, opens up a world of digital payment options (like Apple Pay, Google Pay, PayID, Samsung Pay, Fitbit Pay, and Garmin Pay), and won’t charge you foreign transaction or ATM withdrawal fees. ubank’s Spend Account also took out a 2022 Mozo Experts Choice Bank Accounts and Savings Award in the Exceptional Everyday Account category.

* WARNING: This comparison rate applies only to the example or examples given. Different amounts and terms will result in different comparison rates. Costs such as redraw fees or early repayment fees, and cost savings such as fee waivers, are not included in the comparison rate but may influence the cost of the loan. The comparison rate displayed is for a secured loan with monthly principal and interest repayments for $150,000 over 25 years.

** Initial monthly repayment figures are estimates only, based on the advertised rate. You can change the loan amount and term in the input boxes at the top of this table. Rates, fees and charges and therefore the total cost of the loan may vary depending on your loan amount, loan term, and credit history. Actual repayments will depend on your individual circumstances and interest rate changes.

^See information about the Mozo Experts Choice Home Loan Awards

Mozo provides general product information. We don't consider your personal objectives, financial situation or needs and we aren't recommending any specific product to you. You should make your own decision after reading the PDS or offer documentation, or seeking independent advice.

While we pride ourselves on covering a wide range of products, we don't cover every product in the market. If you decide to apply for a product through our website, you will be dealing directly with the provider of that product and not with Mozo.