What is pet insurance?

Pet insurance is a health policy designed specifically for domesticated pets, like cats, dogs and some may even cover rabbits and birds. It can help reimburse the cost of vet bills you've already paid so your sick pet can receive the medical treatment they deserve and you can worry a little less about life’s surprises.

In this guide, we’ll tell you what you need to know about pet insurance so that you can find the best pet insurance policy based on what your furry friend needs.

What kinds of pets can I insure with pet insurance?

Pet insurance is available for a surprising variety of animals these days, from your dogs and cats right through to fish and lizards. While policies for dogs and cats are, not surprisingly, the most widespread, options do exist for many others.

For more adventurous pet choices like birds, lizards, ferrets and fish, there’s at least one option we’re aware of that will consider these pets. Horses, due to their complexity and value, are covered by their own specialised equine policies, and working animals also need specialist cover.

Just remember, most policies are for domesticated animals. You generally won't find coverage for wild animals or those that are legally prohibited as pets.

Expand the content below for specifics on two of our favourite furry friends.

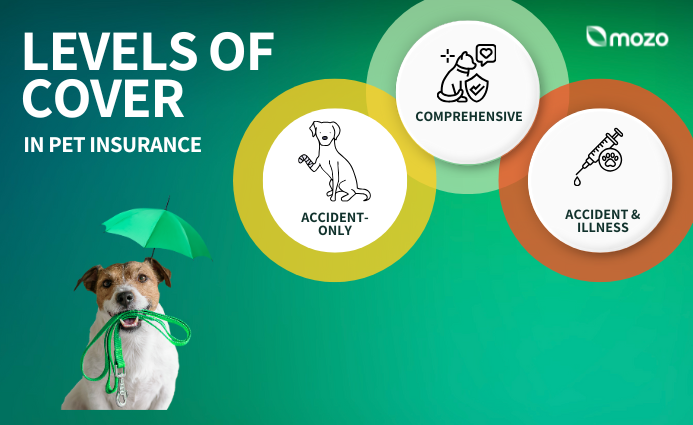

Pet insurance broadly comes in three main types, as you’ll see below. Just be aware: unlike car insurance, policies aren't standardised and can vary significantly between insurers, even within the same ‘level’.

Expect major differences in benefit percentages, annual limits, and what specific treatments are included, so always review policy details carefully.

That said, here's a basic breakdown of each main type of cover:

-

Accident-only cover. Covers injuries (e.g., broken bones, bites) but excludes illness, chronic conditions, or routine care.

-

Accident & illness cover (A&I). Covers injuries and illnesses (e.g., infections, cancer). Routine care is an extra.

-

Comprehensive cover. Includes accidents, illnesses, and some routine care (e.g., check-ups, flea treatments). Some benefits may be bundled or optional.

For help understanding different policy structures and what to watch for, head to the FAQs at the bottom of the page.

What does pet insurance cover?

While policies vary, pet insurance can include a combination of the following cover types, depending on the provider and the level of cover you choose:

| Category |

What it can cover (depending on your plan) |

Accidents

|

Injuries (e.g., broken bones, cuts, poisoning), emergency surgery, hospitalization.

|

Illnesses & conditions

|

Infections, cancer, chronic conditions (e.g., diabetes, arthritis), organ/gastro/skin/ear/eye issues, hereditary/congenital conditions (e.g., cruciate ligament, tick paralysis), medications, ongoing treatment.

|

Consults & diagnostics

|

General and specialist vet visits, lab tests (bloodwork, biopsies), radiology (X-rays, MRIs, ultrasounds).

|

Routine & preventive care

|

Vaccinations, parasite prevention, annual check-ups, desexing, microchipping, some dental cleanings.

|

Specialised therapies & complex procedures

|

Alternative treatments (acupuncture, physiotherapy), behavioral therapy, complex dental work.

|

Emergency & other

|

End-of-life care (euthanasia, cremation), emergency boarding (if owner hospitalised), overseas vet care, third-party liability.

|

Be aware that all policies come with exclusions. For example, pre-existing conditions are almost never covered, and some elective or breed-specific procedures might be excluded. For full details on what isn't covered, always review the Product Disclosure Statement (PDS) or contact the insurer directly. You can also check out the FAQs below for more about exclusions.

How much does pet insurance cost?

Many factors go into determining the cost of pet insurance. These can include the type of pet you own, where you live, your level of cover, any optional extras you add, and your pet’s size, age, and lifestyle.

According to Mozo's 2024 Pet Insurance Report, here is the average monthly cost for cats and dogs of various ages:

| Pet |

1-year old |

5-year old |

Dog

|

$113

|

$137

|

Cat

|

$59

|

$68

|

Did you know your pet's breed also plays a part in the price of your insurance premium? Our report mentioned above also details the different insurance costs of dog breeds, showing Rottweilers as the most costly and terriers as more affordable dogs to insure.

How can I find cheap pet insurance?

Comparing pet insurance quotes and policies can be an excellent way to suss out cheaper options and save money on your pet insurance.

Start by checking out winners from the 2025 Mozo Experts Choice Awards where our expert judges identified comprehensive pet insurance policies recognized for their exceptional value. Here's what to do after that:

-

Check the coverage. Make sure the plan covers what you need, whether it's accidents, illnesses or more, plus consider any breed-specific requirements. You don't want to miss out on crucial treatments your pet may need.

-

Understand limits and your excess. A higher excess generally lowers your premiums, and vice versa.

-

Know your reimbursement. This is what the insurer will pay back to you after your vet visit. It directly impacts your out-of-pocket costs for treatment.

-

Get quotes. Once you've found a few plans you like, head to their website and get a quote. They're free and will give you a general idea of what you might pay.

-

Ask for discounts. Many insurers often have discounts for multiple pets or paying your premiums annually.

It's always a good idea to check the product disclosure statement (PDS) of any policies you're considering, or consider calling up the insurer for answers to any questions you have.