Ubank introduces 5.00% welcome rate on its popular High Interest Save Account

If you’ve got plans to kick-start your savings nest egg this new financial year, popular digital bank ubank, has just made some changes to its High Interest Save Account including a higher balance limit you can earn interest on, and for new customers, a 5.00% p.a. welcome rate for the first 4 months.

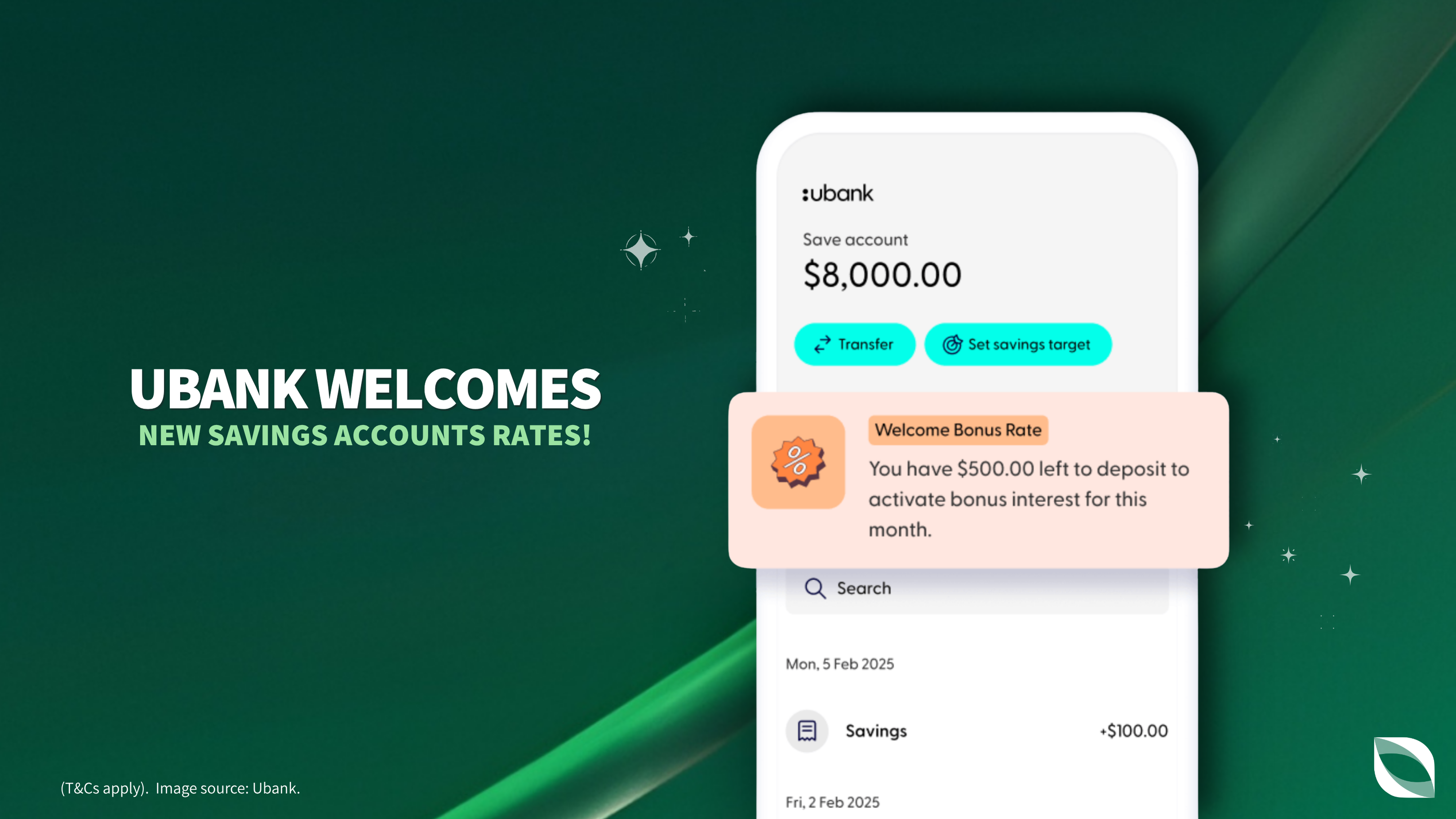

To get the 5.00% p.a welcome rate, customers need a Spend account and deposit at least $500 a month into any of their ubank Spend, Save or Bills accounts (not including internal transfers). After the first 4 months, customers will continue to get the everyday bonus rate of 4.60% p.a. on balances up to $1 million (previously the cap was $250K) as long as they meet the monthly deposit criteria. If conditions aren’t met, the rate drops to zero unfortunately.

You can have up to 10 save accounts and earn the bonus interest on all of them. This means that you can split out your short and long term savings goals into different accounts for easy tracking and management and still earn the highest rate.

And to help ensure that you never miss out on your bonus interest, the ubank app comes with nudge notifications to remind you to make your deposit.

The other great feature of the account is that you can make withdrawals without affecting your bonus rate. For many bonus savings accounts in the market one of the key criteria for earning bonus rates is not making any withdrawals so this is a big plus.

Compare options

Check out details of the ubank high interest account below compare it with savings accounts in our database before applying to make sure it's the right account for your savings needs.