AMP Bank App review: finally, banking that prioritises user experience

Clunky interfaces, confusing navigation, and feature bloat have long plagued the digital banking experience, especially when you’re just trying to do the basics. But that tide is starting to turn.

With a wave of new digital players and a fresh approach from existing institutions, banking apps are finally feeling more like the tools they should’ve been all along: simple, focused, and actually easy to use.

Clean break, clean interface

Launched in early March, AMP Bank’s new app is one of the more notable local examples. Separate from the long-running My AMP app, this new standalone app isn’t just a reskin, it’s a complete rethink. And for users who’ve had their fill of bloated apps with tabs they never touch, that’s welcome news.

Rather than try to do everything, the AMP Bank app focuses on what most people need day to day: checking balances, making fast transfers, viewing transaction history, and managing a straightforward everyday transaction or business account . It’s clean, quick, and avoids the “digital Swiss army knife” approach that’s become all too common in legacy banking apps.

Built for simplicity, and real life

The app is built around everyday usability, with features like PayID , scheduled payments, biometric login, and real-time notifications. It also includes a native business account option – not just a rebranded personal account – a big win for sole traders and small business owners .

And because it’s separate from the My AMP experience, it doesn’t inherit the complexity that comes with handling multiple financial products in one place. It’s banking, without the baggage.

Smart features that make a difference

AMP Bank's new app isn't just about a cleaner look, it's packed with features designed to make banking more intuitive and secure:

- Numberless debit cards: In partnership with Mastercard, AMP Bank has introduced Australia's first numberless debit cards. By removing visible card numbers, these cards aim to reduce fraud and scams. Card details are securely stored within the app and accessible for single-use transactions, boosting security and giving you more control of your information.

- Enhanced security: The app offers advanced security features like biometric authentication (face and fingerprint ID) and proactive fraud protection, ensuring your data is in safe hands.

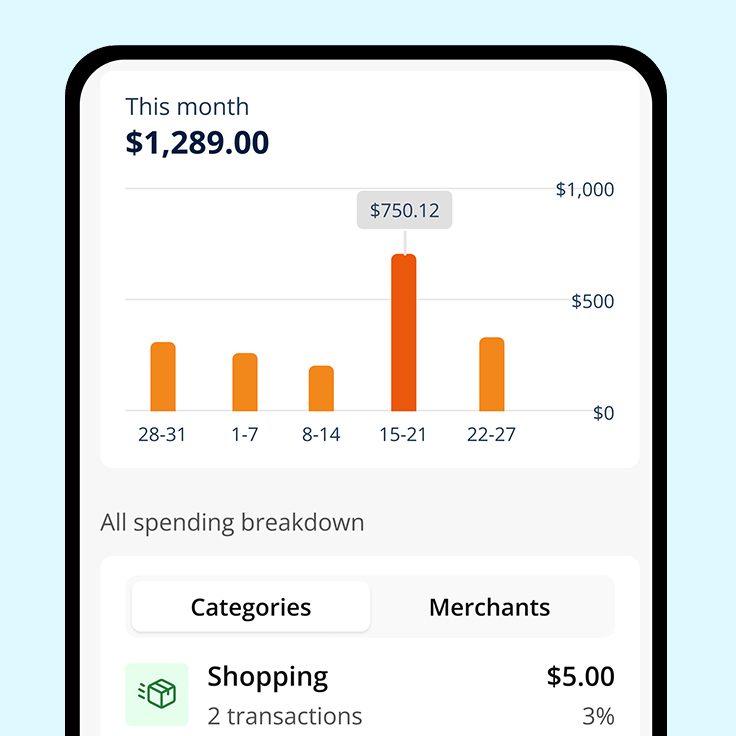

- Expense tracking: Easily track your expenses with simple categorisation and intuitive graphs, helping you understand where your money goes and take control of your finances.

- 24/7 support: Whether you're up at 2am or halfway around the world, AMP Bank offers 24/7 support through live chat and voice calls, ensuring help is always available when you need it.

- Seamless integration: The app is designed to integrate with small business management software, making accounting, cashflow tracking, and tax easier for small business owners.

Seeking a fresh digital banking experience?

If your current bank app feels more like a throwback than a tool built for 2025, it might be time to see what else is out there. AMP’s new app isn’t trying to do it all – and that’s exactly the point.

Sometimes, less really is more, especially when it comes to your money. If you’re unhappy with your bank account check out the AMP Everyday Account and Everyday Business Account below.