$851m lost to scams in 2020, PayPal announces first-ever rewards credit card & home reno money-saving hacks: This week’s best banking news

- Aussies lose $851 million to scams in 2020, says ACCC

- PayPal announces the launch of its first-ever rewards credit card

- $20 billion worth of home loan refinances took place in April

- SMEs say their biggest money stress is no longer pandemic-related

- How to get bang for your buck on your home reno

- Earn Qantas Frequent Flyers points with a Symple personal loan

All in this week’s best banking news recap: editor’s pick.

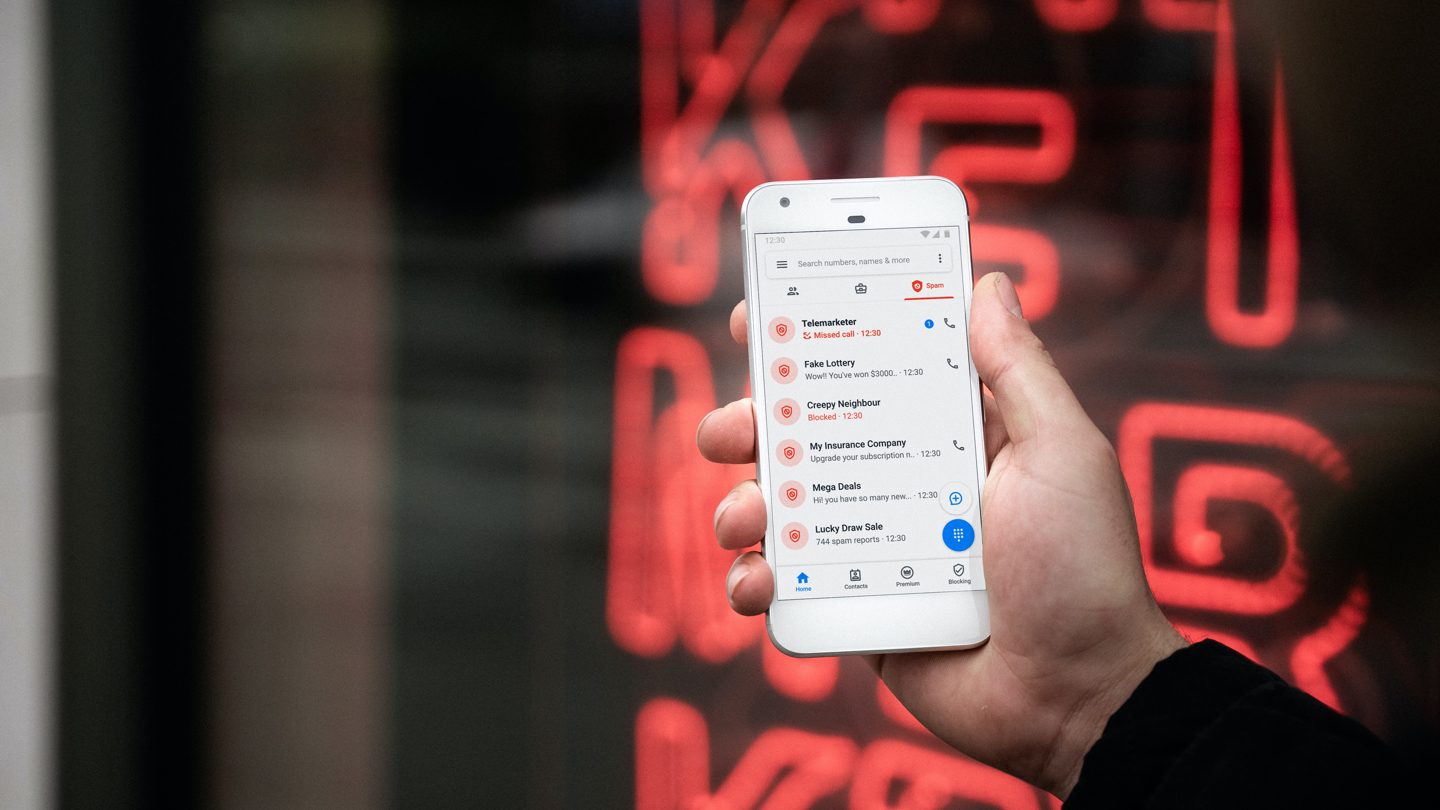

Aussies lose a record $851 million to scams in 2020, says ACCC

According to the Australian Competition and Consumer Competition (ACCC), Australians lost an astronomical $851 million to scams in 2020. This was a 23% increase from that of 2019, making it the highest year of scams ever recorded by the ACCC.

Last year over 444,000 reports were made to Scamwatch, ReportCyber as well as other government agencies, plus ten major banks and financial intermediaries recorded over $851 million lost to scams.

However, it appears that according to the ACCC, numbers could be much higher than that which was reported, with an average loss of approximately $7,677 for each affected Aussies, says the ACCC.

Read the full article: Australians lose a record $851 million to scams in 2020, says ACCC to get the full scoop.

PayPal announces the launch of its first-ever rewards credit card

This just in: digital payment giant PayPal announces the launch of its very first rewards credit card Down Under.

What this means is that PayPal will be extending its online services to physical stores - meaning that customers will soon be able to use PayPal as a payment method anywhere around the globe where Visa is accepted.

On top of this, customers will be able to earn points on eligible purchases, which can then be redeemed at any one of its 750,000 businesses worldwide that have PayPal integrated at checkout (over 300,000 of which are based in Australia).

Read full article: PayPal launches rewards credit card in expansion to physical stores to find out all the nitty-gritty details.

Aussies refinanced $20 billion worth of home loans in April

According to the latest Australian Bureau of Statistics (ABS) lending indicators , approximately $20.4 billion worth of home loans were refinanced in April. Of this, $13.6 billion were from owner-occupiers and $6.8 billion from property investors.

Overall, total refinancing levels decreased by roughly 9% in April when compared to March. However, the sheer amount of refinancing that took place among owner-occupiers means that total refinancing amounts were quite high in April when compared to the past twelve months.

Read the full article: Australians refinanced $20 billion worth of home loans in April, ABS figures reveal to learn more.

SMEs say their biggest money stress is no longer pandemic-related

While the financial impacts of COVID-19 are somewhat decreasing, small businesses now face a flurry of other financial pressures which are now back up at pre-pandemic levels.

A new report from accounting platform MYOB reveals that the top concerns for small to medium-sized enterprises (SMEs) over the past six months were cash flow and utility costs, say 32% of respondents.

Read the full article: SMEs say their biggest money stress is no longer pandemic-related for the full low-down.

How to get bang for your buck on your home reno

Getting tired of looking at the same old kitchen you’ve had since the early nineties? Then why not take the plunge and kick off a home renovations project?

Recent ABS stats revealed that a total of $2,544.6 million worth of home alterations and additions went down in Australia last December. This equates to 3.1% more than that of September 2020 and a further 9.8% leap from December 2019’s figures.

Read the full article: More Aussies renovating homes: 3 expert ways to get value for your money a full rundown on everything you need to know if you’re considering doing some home renos.

Earn Qantas Frequent Flyers points with a Symple personal loan

Melbourne-based online personal loan lender Symple has just announced its exciting new partnership with Qantas Frequent Flyer.

This new partnership means that new Symple customers can now earn up to 50,000 Qantas Points when they get approved for a personal loan (1 Qantas Point per $1 borrowed, with a 50,000 Qantas Point-cap).

Read the full article: Qantas Frequent Flyers can now earn points with a Symple personal loan to find out more about this exciting new offer.

On the hunt for a personal loan? Then check out our personal loan comparison tool below so you can shop around and compare options today: