Thinking investment property? Don’t overlook these rival lenders taking on the big banks

With the Reserve Bank of Australia (RBA) moving into a rate-cutting cycle, borrowing capacity is opening up for property investors.

Read more home loan newsWe’ve crunched the numbers, read the fine print and researched hundreds of products. Penned by Mozo’s team of money experts, our banking guides help you uncover smart ways to save and get a better deal on your finances.

With the Reserve Bank of Australia (RBA) moving into a rate-cutting cycle, borrowing capacity is opening up for property investors.

Read more home loan news

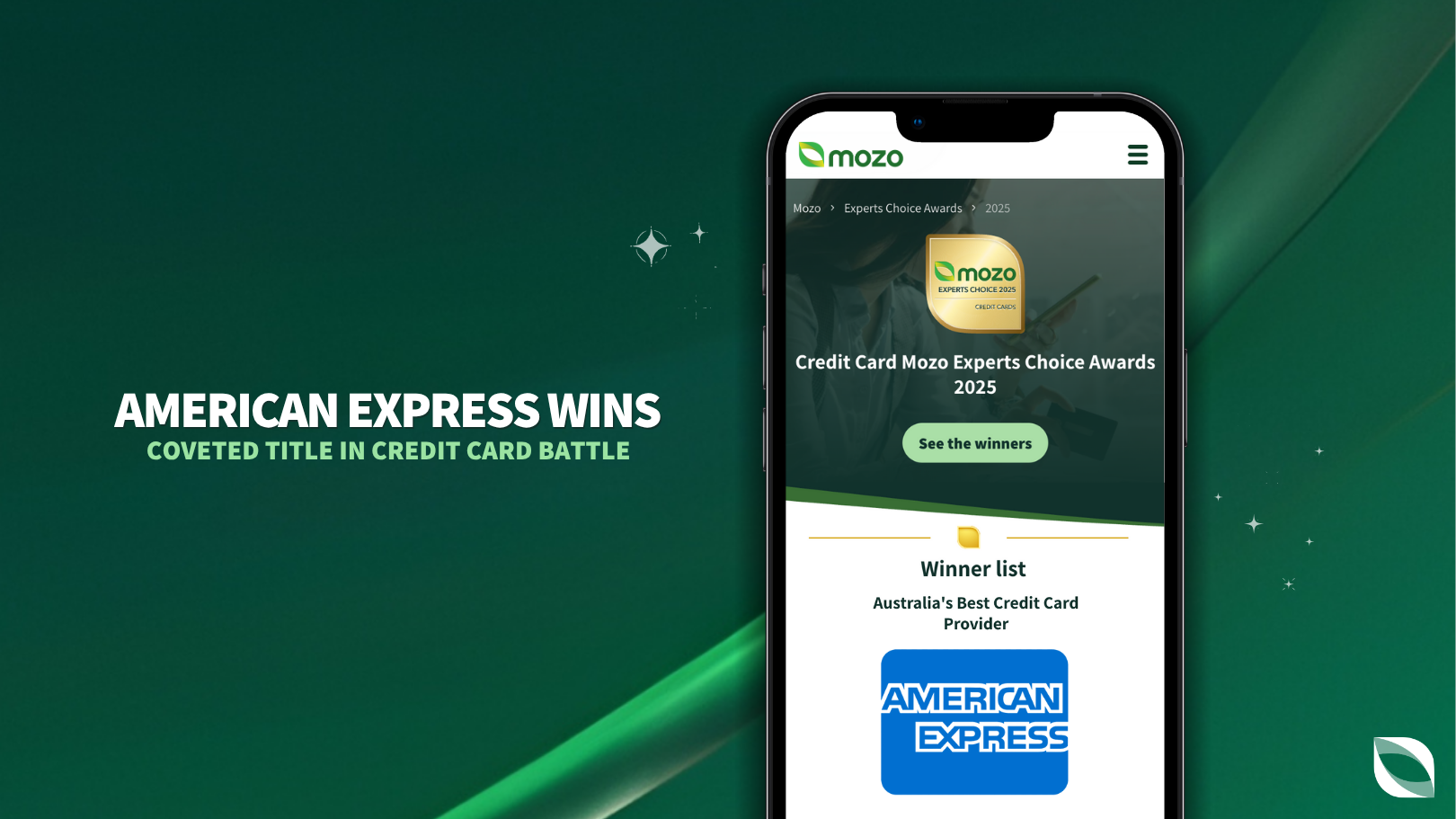

Credit card heavyweight American Express has dominated the 2025 Mozo Experts Choice Credit Card Awards^, scooping up awards across multiple categories and scoring the coveted title of Australia’s Best Credit Card Provider.

Read more credit card news

The summer holidays are right around the corner, and while the kids might be focused on fun and games, it could also be the perfect time to tackle some budget-friendly home renovations. Whether you’re looking to boost your home’s value before selling or just want to refresh your space, there are plenty of smart, cost-effective projects that can make a big impact without breaking the bank.

Read more personal loan news

Seeking a competitive savings account? Two digital‑first options consistently offering leading rates on Mozo's database are the Rabobank High Interest Savings Account and ubank Save.

Read more savings account news

Qantas Frequent Flyers have long been able to boost their points balance through everyday spending – but now your bank balance could be working just as hard as your credit card.

Read more bank account news

There’s still time for savvy savers to make the most of the current rate environment.

Read more term deposit news.png)

End of year and Boxing Day sales are the perfect time to drive off with a new car at a bargain price. Whether you’ve got your eye on a new electric car model, a family sedan or your dream sports car, dealers are keen to clear stock before the New Year. But before you head to the showroom, it’s smart to ensure your finances are in order.

Read more car loan news%20(1).png)

Whether you're supporting family abroad, paying for international purchases, or managing offshore investments, knowing the latest money-saving strategies for international money transfers can help you keep more dollars in your pocket.

Read more international money transfer newsMozo, Australia's money saving zone, helps you to start saving money by comparing retail banking products like home loans, insurance, savings accounts, credit cards and much more. If you want excellent money saving ideas, we have you covered.

Find out which financial products and services are the best for your situation. Whether you are a student looking for financial advice or a new home owner trying to choose the best loan - there is advice and tips on saving money on the Mozo that will make life easier for you.

Money saving deals are everywhere but you need to know where to find them. Rather than trawling through all of the financial institutions' website, turn to Mozo, where you can find the right deals for you - that's the best way to save money when organising a new loan or term deposit. You could also join the Mozo community,

Need to know how much pocket money is a good amount for child? Or do you need advice on a particular loan decision? No matter how big or small your question Mozo's team of money experts will be able to answer your query.

Saving money always sounds like a plausible plan, until that unexpected bill comes along! Good money management is a skill that everyone wants, but in reality they may find it hard to actually put into action.

Mozo offers an extensive catalogue of banking and financial reviews, blogs and feature money articles to help you learn how to manage your money. Our articles cover everything from getting a cash management account to exchanging foreign currency for your next big holiday. If you are after up-to-date money saving ideas, then check out these articles - they offer expert advice at the click of a mouse.

If you need ways to help you manage your money you've come to the right place. The first step is to create a budget - our budget calculator can help you work out where you could trim back your expenses to bring your debts under control. Once you feel like you're in charge of your financing, use our savings calculator to start saving for the things you really want - or, if you're ready to make that next big step, use the home loan calculator to see if you're able to buy a house.

These are easy ways to save money - getting advice from the experts and taking advantages of online calculators and searches to work out what the best way for you to save money is - and which financial institutions can provide the best product for you!