Thanks for joining us

This week’s blog is now closed. Stay up to date with current interest rate news on our latest live blog .

This week’s blog is now closed. Stay up to date with current interest rate news on our latest live blog .

The vast majority of lenders in our database (96%) have passed on the Reserve Bank of Australia’s (RBA) cash rate cut of 0.25% to mortgage holders.

But, there are still a few hold outs.

At the time of writing, Freedom Lend and Reduce Home Loans are the only two providers yet to respond to the RBA’s decision last month.

On top of that, Virgin Money home loans announced it would not be passing on the rate cut to its customers.

To complicate the situation, some lenders have shifted on variable interest rates for new customers, but have not publicly stated how (or if) they will be moving interest rates for existing variable rate holders.

Now that the majority of home loan interest rates have settled, it could be a good time to see how your interest rate compares to the competition.

You can start your search by looking at some of the best home loans in our database.

That’s a wrap on this week’s interest rates live blog. We’ll be back Monday with more live updates on rates and banking.

Australia’s corporate regulator has issued a warning to payday lenders, which it says could be breaching consumer protection laws following a recent review.

ASIC says its review into payday lenders found some may be trying to provide vulnerable consumers with forms of credit that have fewer protections and greater risk.

In addition to entering consumers into unsuitable contracts, the regulator identified that payday lenders could also be “failing to identify an appropriate target market and distribute their products accordingly.”

ASIC’s commissioner, Alan Kirkland says that if it finds payday lenders in serious breach of the law, ASIC will consider further action.

“Consumers who access these products are often financially vulnerable,” said Kirkland.

“That’s why people who use small amount credit contracts are subject to additional protections.”

We review many types of loans at Mozo, and you can compare personal loans that are regulated by ASIC if you’re in need of something short-term.

The Insurance Council of Australia has declared an Insurance Catastrophe for south-east Queensland and northern NSW regions impacted by Tropical Cyclone Alfred since late February.

Despite the cyclone weakening before landfall, communities continue to face power outages, heavy rainfall, flooding, and damage from debris. Over 44,000 claims have been lodged, with numbers expected to rise in coming weeks.

Insurers have improved since the 2022 floods, proactively contacting more than a quarter of a million customers with safety advice and claims lodgement information. Additional claims consultants were deployed, round-the-clock response teams engaged, and temporary accommodation pre-reserved.

Thankfully, concerns about widespread severe wind damage have not materialised to the extent initially feared, though the clean-up process remains underway.

If you're looking to review your home insurance and get better protection ahead of future storms, be sure to check out our home insurance hub page for coverage options.

Good morning, welcome back to our ongoing live coverage of interest rates and banking news.

Despite the old advice that a "good job that pays good money" is all you need to buy a home, new research from the Australian Institute reveals a stark reality for deposit savers.

Even after diligently saving 15% of their after-tax income for a decade, average full-time earners still can't afford a deposit on a median-priced home.

In Sydney, the situation is particularly tough. After saving $126,000 over ten years, prospective buyers would still need an additional $155,404 to secure a 20% deposit—essentially going backwards despite their efforts. Those ten years of saving only eliminated 3.4 years of a 15.4-year saving journey, as per the Australia Institute data.

Brisbane homebuyers face a similar struggle—after a decade of saving, they still need another 4.5 years to reach their goal, a figure that hasn't improved in nearly five years.

Fortunately, many lenders now offer various deposit options with different Loan-to-Value Ratio (LVR) levels, potentially making homeownership more accessible for first-time buyers facing this uphill battle.

For example, in the Mozo database there are a number of home loan providers offering a loan with a 10% deposit, such as Mozo Experts Choice Award winner, loans.com.au. Its Variable Home Loan 90 has an LVR of 90%, provided borrowers meet the necessary criteria.

Opting for a smaller deposit will also make your home loan larger and this needs to be accounted for. You can compare top loans on our Home Loans hub page , but always consult an expert before embarking on a low deposit loan.

You can see Mozo’s live tracker to learn which lenders have cut interest rates.

Fuelled by the RBA’s recent rate cut, property prices in Australia’s most expensive markets have increased by 0.2% after dipping -0.3% in January. This 0.5% swing marks the sharpest month-to-month turnaround among market segments in the country, although the lower and middle-priced tiers actually saw larger overall gains in February.

CoreLogic economist Kaytlin Ezzy says the higher end of the market is usually more sensitive to rate changes and that recoveries in these markets often serve as a sign of more to come.

“The upper 25 percent of values in Melbourne, Sydney and Hobart recorded the largest improvements,” she said. “The top quartile is the one to watch, as they tend to be a bellwether for broader market recoveries.”

If Ezzy is right, property prices across the board could gain even more momentum. And while that’s good for home owners and investors, it could spell trouble for first-time home buyers. As we reported last week, mortgage stress is rising for this cohort.

A recent Domain report found that mortgage repayments on entry-level houses now exceed 30 percent of a typical buyer’s income in every capital except Darwin. Five years ago, no city had first-home buyers under mortgage stress for units, but now Sydney, Brisbane and Adelaide have crossed that line.

With mortgage stress on the rise, finding a competitive home loan is more important than ever. Comparing rates and securing a lower-cost loan could make all the difference if you’re trying to break into the market before prices climb further.

Our live interest rate tracker is where to go if you want to find out who’s cutting rates, when and by how much.

And that does it for the day. Check back in tomorrow for more live blog coverage of all things interest rates, home loans, savings and more!

Household spending dipped in February, with CommBank’s HSI Index down 0.2%. Even Valentine’s Day didn’t do much to lift spending, with the biggest drops in recreation (-1.6%) and hospitality (-1.2%).

CBA senior economist Belinda Allen says the spending pullback is part of a broader trend.

“The lift we saw in spending at the end of 2024, driven by discount and sales activity, hasn’t carried through to the New Year as constrained consumers dedicate a large portion of their wallet to spending on the essentials,” she said.

Food, transport, and education spending also fell, while utilities (+1.9%), health (+0.7%), and insurance (+0.7%) ticked up.

CBA expects consumer spending to stay weak until interest rates come down. Allen says a rate cut could come as soon as May if inflation continues to track toward the RBA’s 2-3% target.

For now, with spending down, some households could be holding onto their cash instead. With interest rates on savings accounts still relatively high, it’s not a bad time to be stashing money away. If you’re looking for a place to park your savings, check out some of the top accounts in our database .

ANZ has just announced a major milestone : its digital banking platform, ANZ Plus, has hit one million customers and nearly $20 billion in deposits. Since its launch in 2022, ANZ Plus has been one of the fastest-growing digital banking services in Australia, offering customers a new, tech-savvy way to manage their finances.

ANZ says its digital banking platform has a strong focus on financial wellbeing. With features like round-ups, card controls, and savings goals, ANZ Plus aims to help customers spend mindfully, save consistently, and stay in control of their financial future. In fact, over half of ANZ Plus customers consider it their primary bank , showing just how quickly this digital-first platform has gained trust. The platform also prioritises security, with 99% of customers opting for Scam Safe fraud protections.

For everyday Aussies , this shift towards digital banking means more control, better tools, and enhanced security. Platforms like ANZ Plus give users a consolidated, real-time view of their finances, making it easier than ever to manage money and stay on top of spending. And with features like ANZ Plus Add-Ons, which let customers integrate third-party services like Qantas Frequent Flyer or Cashrewards, it’s clear that personalisation is key in today’s banking landscape .

ANZ isn’t the only player in the growing world of digital banking. Other banks, including the rest of the Big Four – Commonwealth Bank, Westpac, and NAB – have also jumped on the digital bandwagon with their own digital banking solutions. CBA’s NetBank and CommBank app are known for their robust features and mobile banking capabilities. Westpac’s Westpac Live offers a user-friendly interface with a strong focus on security, while NAB’s NAB Digital Banking is gaining traction for its no-fee options and simple, intuitive app design.

With so many options out there, how do you know if ANZ Plus is right for you? That’s where comparing providers and products comes in handy. Mozo lets users compare a wide range of banking solutions, including digital accounts , savings accounts , home loans and more, so you can make an informed decision about what’s best for your financial needs.

Good morning and welcome back to Mozo's live coverage of everything interest rates! Stay tuned as we dive into today's news.

The Australian Energy Regulator (AER) has announced a draft decision to increase electricity prices for the 2025–26 period. Residential customers in New South Wales, South East Queensland, and South Australia could see electricity bills rise by varying percentages, depending on region.

These proposed hikes are primarily due to increased costs in generating electricity and maintaining the infrastructure that delivers power to our homes and businesses. Factors such as recent coal outages and rising wages have contributed to these higher expenses.

While these changes may add to existing cost-of-living pressures, there are steps you can take to manage your electricity expenses. Exploring different energy plans and implementing energy-efficient practices can help mitigate the impact of these price increases.

The AER is currently seeking feedback on this draft determination, with final prices to be set after considering public input. Staying informed and proactive can help you navigate these upcoming changes effectively.

Westpac’s latest Housing Pulse report notes that housing has been famously sensitive to interest rate moves in the past, and early signs suggest we are already seeing a positive shift after the RBA’s February 0.25% rate cut .

However, housing markets are coming off a cycle that was "surprisingly disconnected from interest rates," says Westpac’s head of Australian macro-forecasting, Mathew Hassan.

"The initial price-led upturn in 2023 formed and sustained despite active RBA rate hikes that were taking mortgage rates to 15 year highs," Hassan said.

Interest rates on home loans have come down and that hopefully means better value home loans overall.

But housing affordability is still poor, says Hassan, and the short supply of homes in most locations makes life tough for prospective buyers.

So what can we expect?

Westpac surveys buyer intention and this can help assess how Aussies are thinking right now. For example, as of early 2025 three-quarters of consumers still have property–related intentions over the next five years.

Those looking to ‘pull the trigger’ on a purchase over the next 12mths was significantly higher.

Hassan says there’s an expectation that 2025 will provide a good opportunity for these people to finally make a move.

If you're in that category, check out some of the leading loans in our database on our Home Loans hub page .

Okay, that does it for the live blog today! Thanks for joining us and be sure to tune in tomorrow for more coverage of all things interest rates, personal finance and banking.

With the RBA’s easing cycle underway, and with underlying inflation moderating, more interest rate cuts are likely this year , says Bendigo Bank’s chief economist, David Robertson.

"Market pricing now matches our forecast of two more rate cuts, taking the cash rate down to around 3.6% by year-end ," Robertson said in his latest economic update.

Over the past few weeks many home loan interest rates have been cut, which is good news for those considering a home purchase. Robertson thinks homeowners may need to wait a little for the next cash rate cut however.

"We continue to expect a relatively shallow easing cycle, and agree with the RBA that it would be foolish to rely on an April 1 cut," he said. "However, the next quarterly CPI data out on April 30 should reveal more evidence that inflation is slowing, allowing a second rate cut on May 20.

"Our base case forecasts centre on a steady improvement in GDP growth in 2025 and cost of living pressures subsiding as inflation moderates, further helped by RBA rate cuts and last year’s tax cuts, but the global backdrop remains as unpredictable as ever.”

Robertson adds that there are three key complications for the RBA in continuing its easing cycle, which will greatly influence the markets through the year.

The first is the recent pick-up in retail sales , up another 0.3% in January as consumers become more confident about the outlook.

The second is ongoing public spending at a state and federal level, ahead of impending elections.

And the third is the r esilience of labour markets , with employment growth still powering ahead.

"As the RBA noted, the strongest case for not cutting rates last month was continued tightness in labour markets although the minutes also noted that there was possibly more capacity in the labour markets than previously judged," Robertson said.

"So, while we continue to forecast a slightly higher unemployment rate, this may not be a pre-requisite to the two more cuts we expect later this year."

If you're considering a home loan, you can compare some of the best loans in our database on our Home Loans hub page .

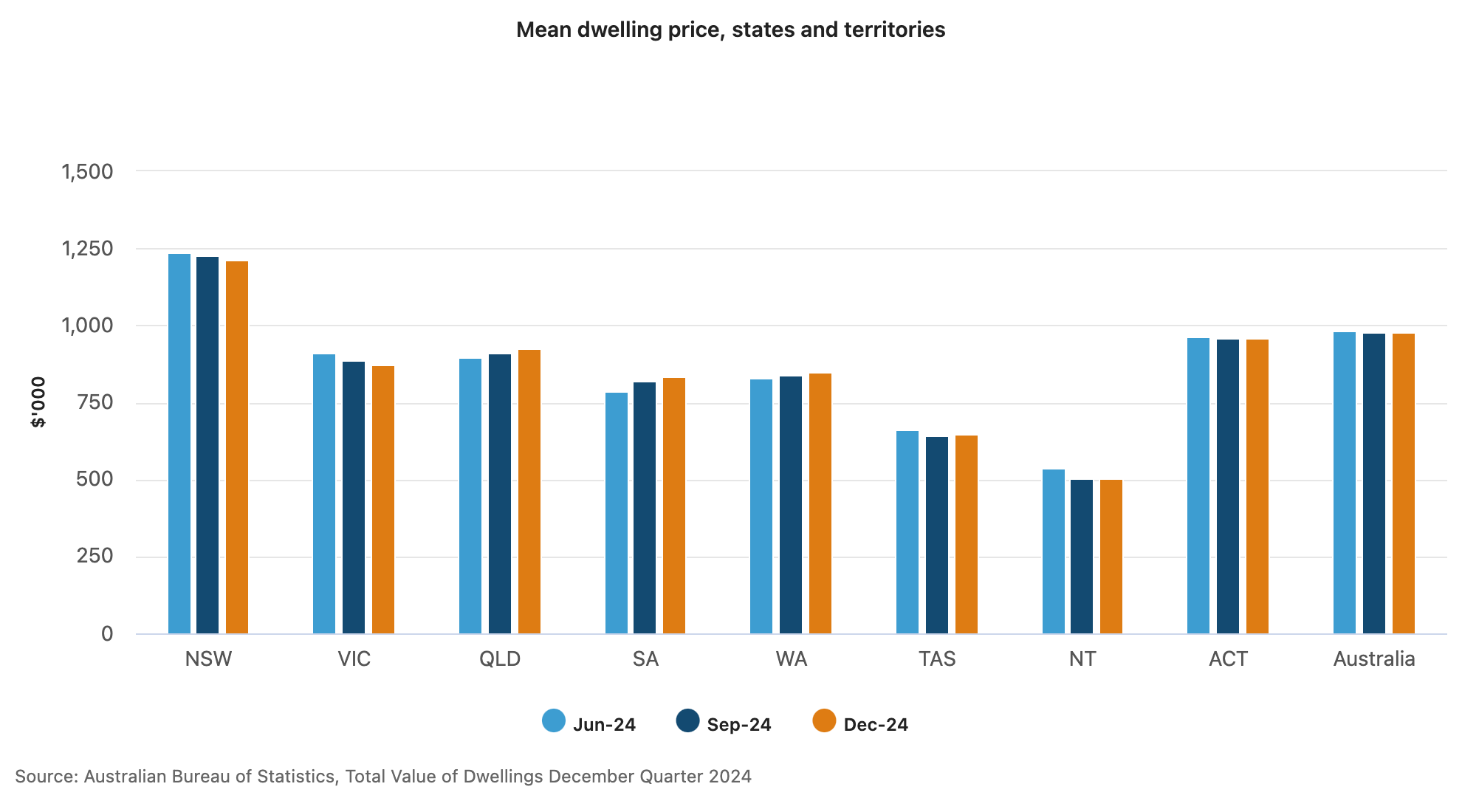

Australia’s total residential property value rose by $26.4 billion in the December quarter to reach $11.03 trillion, even as the mean home price dipped slightly to $976,800, according to the latest ABS data .

The latest figures also show that while the RBA’s recent rate cut has eased home loan costs, property prices remain high, particularly in New South Wales, where the mean home price sits at $1.21 million. While NSW’s mean price fell by 0.4% over the quarter, this was likely due to an increase in housing supply, with the ABS reporting 53,200 more residential dwellings across the country.

More affordable markets include South Australia at $834,700 (+2.4%), Tasmania at $645,200 (+1.2%) and the Northern Territory at $500,900 (+0.3%).

This data once again highlights how an affordable mortgage and an affordable home don’t always go hand in hand.

The Reserve Bank of Australia (RBA) is worried about banks’ plan to scrap the Bulk Electronic Clearing System (BECS), which processes nearly $18 trillion in payments each year. While banks want to shift to the New Payments Platform (NPP) by 2030, the RBA says poor planning could cause major disruptions.

BECS has been around for 30 years, handling wages, welfare payments, and bills. If the transition isn’t smooth, Aussies could face delays getting paid or making payments – shaking trust in the system.

The RBA wants banks to lay out a clear plan, explore backup options, and ensure a well-managed transition. As changes roll out, it’s worth keeping an eye on updates from your bank.

Good morning! Welcome back to our ongoing live coverage of interest rates and banking news.

If you’re unnerved by the way savings interest rates are taking a plunge, it might be time to consider the benefit of a short term deposit.

Term deposits come in different lengths, which means you can park your money - at a fairly good level of interest - while you ponder the future of your savings account .

You needn’t put all your money in the term deposit either, but rather a portion that will earn a fixed interest rate, while savings accounts move in the current rate cutting cycle.

Take a 1-year term as an example, which in early 2025 are typically holding well above 4% p.a. interest and in some cases are closer to 5% p.a.

For example, Heartland Bank offers 4.90% p.a. for 12 months, which is among the term deposit leaders in the Mozo database.

A saver can earn 4.95% p.a. by dropping to a 9-month term with Heartland.

Mozo Experts Choice Award winner, Judo Bank has a 12-month term deposit offering 4.70% p.a. If you're happy to just park your money for 6 months, Judo will actually offer 4.85% p.a.

Similarly, MyState Bank offers 4.75% p.a. on 6 months and 4.60% p.a. for 9 months.

There are other options, it just takes a little research and comparison.

You can easily compare interest rates on our term deposits on our hub page.

The major news in property this week is that home auctions have been softer lately.

CoreLogic's latest Property Market Indicator Summary shows that preliminary auction clearance rates across Australia's combined capitals have fallen to 69.6%, marking the second consecutive week with rates below the 70% threshold.

The downturn coincides with a significant reduction in auction volumes, with just 1,629 auctions held last week compared to 2,749 the week prior.

Sydney hosted the most auctions with 871 properties going under the hammer, achieving a clearance rate of 70.7% - down from 71.4% and the lowest in five weeks.

Does this present a window for would-be buyers?

Check out our story on how a softening auction market creates opportunity for home buyers .

And that does it for the live blog today. Be sure to tune in tomorrow for more live coverage of all things interest rates and banking!

You can see Mozo’s live tracker to learn which lenders have cut interest rates.

ING says it’s the first bank to participate in the Nationwide House Energy Rating Scheme (NatHERS) trial for existing homes.

This initiative is led by the Australian Government and aims to help Australians better understand their home’s energy use, identify cost-effective upgrades and help reduce energy bills.

ING’s head of home loans, George Thompson says the project is a leap forward in helping to remove the complexities and confusion that can come with retrofitting a home.

"With the knowledge gained through this trial, customers will have a better indication of what home improvements to prioritise to deliver the best energy efficiency and cost outcomes," Thompson said.

From last month, select ING customers applying to refinance or top up their mortgage were said to be invited to take part in the trial.

NatHERS is the Nationwide House Energy Rating Scheme, providing energy ratings for new Australian dwellings. It has established itself as a trusted source for home energy assessments and ratings for new homes and major renovations.

Through the trial, NatHERS is set to extend to existing homes , creating an opportunity to help households reduce their energy use and improve thermal performance while reducing emissions and supporting Australia’s plan of reaching net zero by 2050.

At Mozo, we focus on helping you get the best out of home ownership. If you’re looking to take out a new home loan or refinance an existing mortgage, be sure to compare rates, fees and features.

The momentum that might have been expected after the Reserve Bank’s interest rate cut hasn't held - at least in terms of 'consumer confidence'. (Those looking to get a cheaper home loan you'd think would be much more confident - but I digress!)

Roy Morgan reports that we're less confident this week on the basis of overall household finances.

This is notable because last time the RBA cut rates in late 2020, confidence rose for two straight weeks and for five of the six weeks after the cut.

Read more on how we're feeling about the economy right now but also how Aussies are well-versed in budgeting and saving.

MyState Bank has slightly lowered its term deposit interest rates .

The Tasmania-based bank has reduced its six month term deposit by 0.10% p.a. – effective from today (11 March). That brings its rate down to 4.75% p.a.

Despite the change, MyState Bank’s six month term deposit of 4.75% p.a. is still the highest offered by the bank.

It has also cut 0.05% p.a. off its one year term deposit , bringing the rate down to 4.55% p.a.

At the time of writing, the highest rate in our database for a six month term deposit is 4.89% p.a. from Heartland Bank, but it requires a minimum deposit of $25,000.

MyState Bank has a minimum deposit of $5,000, opening the door to many more investors.

Donald Trump’s recent decision to impose 25% tariffs on steel and 10% tariffs on aluminium imports is expected to have ripple effects on Australia’s economy, particularly its property market.

With higher costs for building materials, construction could become more expensive, further exacerbating Australia’s housing shortage. Developers might delay or cancel projects, reducing the supply of new homes, which could push up prices for existing properties.

In addition to rising construction costs, inflation from the tariffs could lead the Reserve Bank of Australia to raise interest rates, making home loans more expensive. This could cause potential buyers and investors to hesitate, slowing demand and potentially cooling the property market.

While the full impact remains to be seen, these economic shifts suggest that Australia’s property market may face increased costs and reduced affordability in the short term, and a cooling effect in the long-term.

Major banks have warned Australians to be on alert for scammers in the wake of ex-Tropical Cyclone Alfred.

Westpac says scammers may impersonate banks, insurance companies, charities or government agencies to prey on those looking for support, but they can also target people looking to help by posing as a legitimate charitable organisation.

“For instance, scammers might offer financial aid to those directly impacted, preying on their urgent need for assistance,” says Westpac’s head of fraud prevention, Ben Young.

“Additionally, they may exploit the goodwill of well-intentioned members of the public who want to help by soliciting donations for those directly impacted,” he says.

ANZ offers some advice for spotting a scam:

Banks, insurers and super funds could face major leadership shake-ups under new governance rules proposed by APRA. The changes aim to prevent governance failures that can lead to misconduct, overcharging and poor customer outcomes, including in areas like

home loans

and

super

.

To learn more about the proposed rules and how they could impact you as a customer,

read more here

.

And that does it for the live blog today. Be sure to tune in tomorrow for more live coverage of all things interest rates and banking!

.png)

ANZ has stepped up its support for customers impacted by ex-Tropical Cyclone Alfred on the east coast.

The bank has confirmed that 37 of its 55 branches previously closed in south-east Queensland and northern New South Wales will reopen today after the severe weather event.

It reports 130 ATMs are now operational across affected regions, with mobile ATMs on standby for communities experiencing extended power and telecommunications outages.

"We are pleased that the majority of our branches are able to reopen today, so we can continue to support our customers with their banking needs," said Cameron Home, ANZ general manager.

ANZ also activated a financial relief package on March 5 for impacted customers, which includes short-term payment relief on loans, fee waivers for restructuring business loans and accessing term deposits early, and emergency support for insurance customers.

Customers are advised to check branch status on the ANZ website before visiting and can contact the bank's dedicated financial hardship team at 1800 149 549 for assistance.

Other big banks have responded in a similar fashion and should be contacted if you need help directly.

Following the RBA’s cash rate decision a few weeks ago, Queensland-based credit union The Capricornian has slashed variable rate home loans for new customers by 0.25% p.a.

For example, the bank's No Frills Home Loan for owner occupiers with a principal and interest loan and loan-to-value (LVR) ratio of at least 90%, now offers a competitive 5.65% p.a. (5.68% p.a. comparison rate).

However, there's been no word on whether or not existing borrowers will receive a similar rate cut.

See more of The Capricornian’s fixed and variable home loan rates and be sure to compare a range of home loans , rates, fees and features before committing to a mortgage.

You can see if, how and when other banks cut interest rates by following Mozo’s live rate change table, found on our RBA rate tracker page. Additionally, if you’re looking to take out a new home loan or refinance an existing mortgage, be sure to compare rates, fees and features.

Very high rents might be the reason some young Aussies have turned to the homebuying market.

Consider that in our most recent Mozo Rental Report , Sydney weekly rents cost $775 (median price).

If you convert $775 weekly rent to a monthly cost of $3,100 (775 x 4), this actually isn’t far off what you might pay for a typical home loan bill per month, albeit a modest one.

Yes, this might require that all the stars - and numbers - align. But it's worth a closer look. Read the full story here >

.jpg)

Good morning and welcome back to Mozo's live coverage of everything interest rates! Stay tuned as we dive into today's news.

A few weeks ago HSBC announced that it would be passing on the Reserve Bank of Australia’s (RBA) rate cut, in full, to existing home loan customers, and those changes are effective today, 10 March 2025 .

The bank trimmed 0.25% off its variable home loan interest rates.

A Mozo Expert’s Choice Awards winner, HSBC’s Discounted Home Value Loan for owner occupiers, paying principal and interest with a loan-to-value (LVR) ratio of 70-80%, is now 5.84% p.a. (comparison rate 5.85%).

This is a highly competitive rate, considering the average variable home loan rate on the Mozo database for loans of $400,000 (OO, P&I, 80% LVR) is 6.49% p.a. and the “best” rate in the database is currently 5.60% p.a.

Two weeks after the RBA delivered its first cash rate cut in over four years , the vast majority of home loan lenders have now followed suit. Last week, 49 lenders reduced their variable home loan rates, bringing the total number of lenders making variable rate cuts to 82.

You can see if, how and when other banks cut interest rates by following Mozo’s live rate change table, found on our RBA rate tracker page. Additionally, if you’re looking to take out a new home loan or refinance an existing mortgage, be sure to compare rates, fees and features.