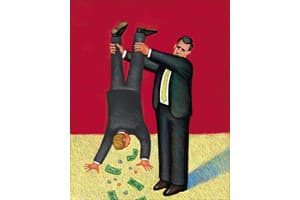

Growing casualties of the new credit card surcharge rules

Consumers are finally starting to see enforcement of the credit card surcharge rules that were imposed by the Reserve Bank of Australia (RBA) earlier this year, reports the News Limited Network.

When the new rules that limit how much surcharge a retailer can charge for credit card payments was brought in by the RBA on the 18 March 2013, many were concerned that retailers would pass it off as a toothless threat that the RBA could never really enforce.

Credit card surcharges were initially meant to help retailers cover the cost of the transaction when a consumer paid by credit card, but with no real restrictions on how much a business can charge, a number of merchants have been taking advantage of the fee as a means to extra revenue.

One carpet store in Sydney has been found to be charging customers as much as 12.5 percent surcharge on credit card transactions and even eftpos payments. The average fee paid by merchants to Visa and MasterCard is 0.79 percent, 1.81 for American Express.

"Anything over... would be considered very excessive," according to head of Visa Australia, Vipin Kalra.

Both Visa and MasterCard have now both forced the retailer to reduce the 'administration fee' since being brought to their attention. The store owner has argued that the charge was necessary to cover the labour hours for the additional administration required for credit payments. However, under the RBA's guidance notes, staff time is not included as a reasonable cost of acceptance.

Similarly, a Sydney travel agent has had its 2.5 percent surcharge halved after a complaint by a consumer who paid a $63 surcharge fee on a tour booking. And since the rules have been brought into place Visa has received more than 50 consumer complaints over excessive credit card surcharge fees.

Although it's a step in the right direction, it remains to be seen whether there will be any action taken on the much larger players, such as the airlines. Jetstar, for one, have received a petition from over 35,000 customers outraged by their $8,50 fee for credit card payments, although the airline denies making any money off the fee.

Many retailers are now looking at those surcharges as part of their margin," says, Lachlan Colquhoun, head of markets analysis at East & Parnters, who do research for the RBA. Mr Colquhoun calls the surcharge fees by airlines as "almost outrageous."

Looking to find a credit card with lowest interest rates or best rewards? Compare credit cards on Mozo

Share your opinion with us here.