.png)

AAMI vs Budget Direct car insurance

AAMI and Budget Direct are two of the most well-known names in Australian car insurance. But beyond brand recognition, how do they really compare?

.png)

AAMI and Budget Direct are two of the most well-known names in Australian car insurance. But beyond brand recognition, how do they really compare?

In most Australian states and territories, the red hot property market continues and this means that if you've got an investment property in your sights, you'll want to keep mortgage costs as low as possible.

AMP Bank GO, launched earlier this year, is offering no-strings-attached savings accounts that challenge the big banks and ditch the usual bonus-rate traps.

.png)

When choosing a super fund, it's hard to look past two Goliaths of the industry: Australian Super and Aware Super. As two of Australia's biggest profit-for-member funds, they both have strong track records.

By far the biggest ongoing expense for the majority of Australian property owners is their monthly mortgage repayments. And yet, we are stubbornly loyal to the banks, often paying higher interest rates than we need to.

According to our home loan experts, if they were to pull together a list of all the things that you’d want in a home loan, it would have a low rate, no fees, features to help you pay off your loan sooner, and come from a trusted lender.

.png)

QBE and Allianz are probably two of the most established names in Australian home insurance. But how do their comprehensive home and contents insurance policies stack up side by side? This comparison takes a closer look at what each insurer offers, looking at features, limits, pricing and quality - to help you figure out which one might suit your needs best.

Shopping for a home loan shouldn’t feel like stepping back in time. Yet, for many Australians, refinancing still means printing stacks of paperwork, booking in-person appointments, and bouncing between phone calls. It’s no wonder the Big Four banks continue to dominate – even with typically higher interest rates – when switching can feel like such a hassle.

Credit card heavyweight American Express has dominated the 2025 Mozo Experts Choice Credit Card Awards^, scooping up awards across multiple categories and scoring the coveted title of Australia’s Best Credit Card Provider.

Seeking a competitive savings account? Two digital options consistently offering leading rates on Mozo's database are the Rabobank High Interest Savings Account and ubank Save.

If you’re looking to grow your savings faster, two of the top performing savings accounts in the market right now are the ING Savings Maximiser and the AMP Bank GO Save account.

Welcome to Mozo Money Moves, your essential guide to navigating the world of personal finance. This week, there's plenty to discover. We've seen some cracking action in the home loan market, with a major lender slicing fixed rates below the 5% mark, which could be a real boon if you're looking for certainty in your repayments. On the flip side, savers might be feeling a bit of a pinch as term deposit rates continue their slide, forcing a rethink on where to stash your cash.

Rising prices at the checkout, at the petrol pump, and pretty much everywhere in between have pushed many Aussies to re-evaluate their weekly budgets. And while inflation may have cooled slightly, cost-of-living pressures are far from over.

Despite the Reserve Bank of Australia (RBA) keeping the cash rate at 3.85 % at its last meeting, Australian banks have been aggressively trimming term deposit rates in recent weeks.

Welcome to Mozo Money Moves, your essential guide to navigating the dynamic world of personal finance. In this edition, we unpack some of the most significant trends and opportunities shaping how Australians save, invest, and spend their money. From competitive savings rates designed to boost your cash to a timeless investing strategy making a comeback, we've got you covered.

Australian property prices are booming, loan sizes are ballooning, and over the last 10 years, the average variable interest rate has also risen. Is it any wonder the housing market is notoriously difficult to crack?

With savings account rates sitting at a measly average of 3.24% in our database*, it’s no wonder many Australians are taking to the stock market as a way of growing their savings. In fact, according to the latest HSBC investor insights survey^ , over half of Australians are investing consistently using the dollar cost averaging strategy.

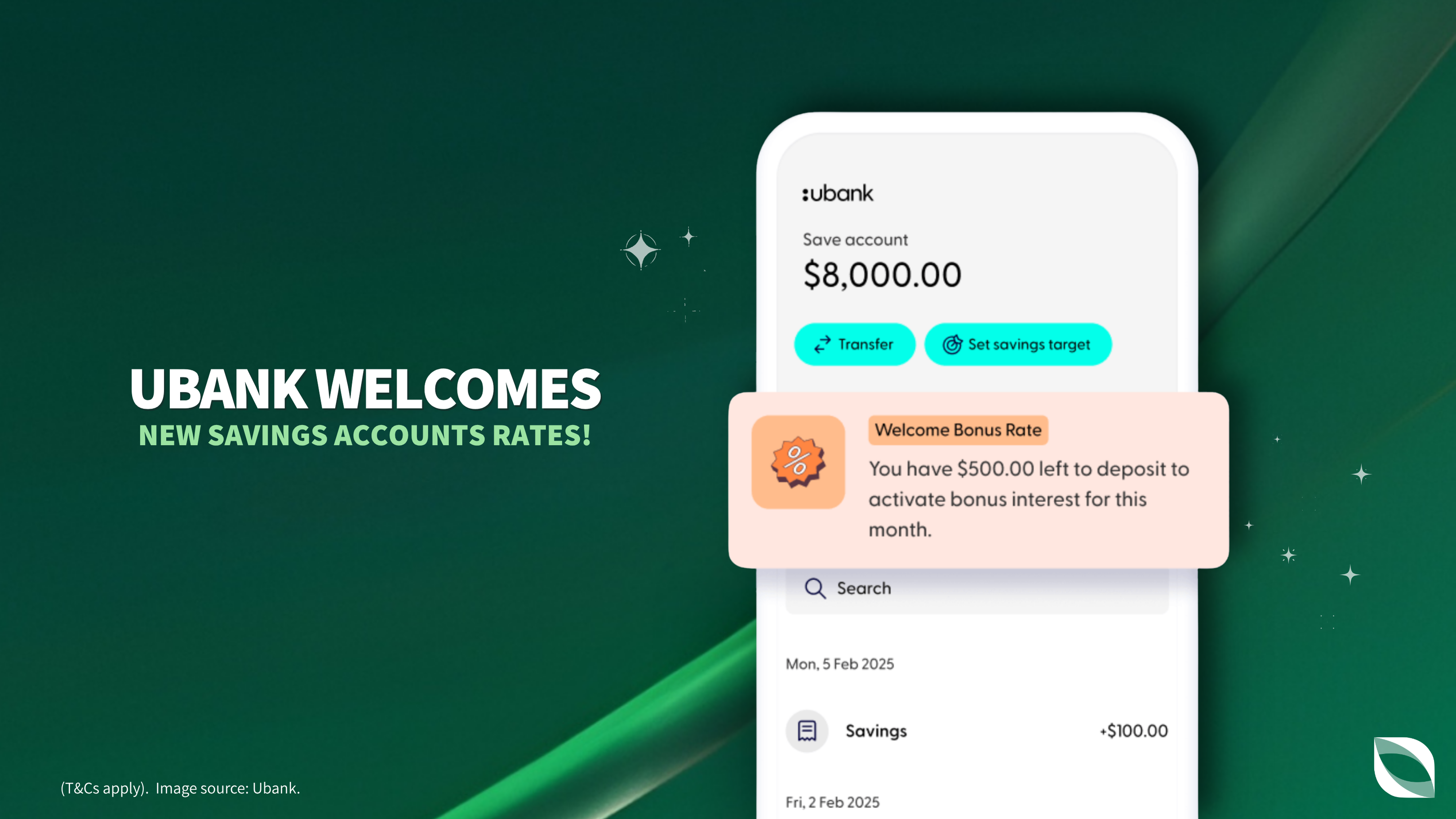

If you’ve got plans to kick-start your savings nest egg this new financial year, popular digital bank ubank, has just made some changes to its High Interest Save Account including a higher balance limit you can earn interest on, and for new customers, a 5.00% p.a. welcome rate for the first 4 months.

Savings rates are slipping again – and for Aussies trying to grow their nest egg, that means finding smarter ways to save has never been more important.

.png)

Super as a whole had a fantastic year, with median balanced options hitting an estimated 10.1% return for the financial year ending June 30, 2025 according to superannuation research firm SuperRatings. This marks the third year in a row of strong performance, a welcome boost for retirement savings

It’s been a big week in banking, with markets shocked by the central bank’s hold and new data revealing just how much more a mortgage costs in 2025 compared to 2015.

The Reserve Bank of Australia (RBA) was widely expected to cut rates at its latest monetary policy meeting. However, that decision did not come to pass. Some would-be homebuyers may be tempted to hold off on entering the market until further cuts are announced.

The Reserve Bank of Australia (RBA) has kept the cash rate unchanged at its latest meeting, despite all of the Big Four banks, most economists and the ASX futures market predicting a cut.

If life insurance or other personal cover is on your mind – perhaps you have a family to protect, a career with unique risks, or simply want the security of knowing you're prepared for unexpected events – then finding a sustainable way to manage premium payments can be a real challenge.

It was a week of fancy footwork as banks repositioned deposit and home loan products before the Reserve Bank of Australia (RBA) rate call next Tuesday. ANZ sliced fixed rates, only to flip its rate cut forecast hours later — which means all Big Four banks are now betting on a rate cut on Tuesday.

.png)

If you're one of the thousands dealing with the aftermath of this week's wild weather, the clean-up phase can be a massive job. With the NSW State Emergency Service (SES) responding to over 4,000 incidents, from flooded homes on the South Coast to widespread wind damage across Sydney, your home insurance plays a key role as you pick up the pieces.

.jpg)

The new financial year has just arrived, making it the perfect time to consider giving your superannuation a significant boost. Making a concessional contribution is a smart way to save for retirement, reduce the tax paid on that income, and potentially place you into a lower tax bracket.