Where can I get a discount on NBN50 right now?

Whether you’re looking to switch from your current NBN provider or are moving house and need a new broadband connection, there are tonnes of NBN deals up for grabs.

Whether you’re looking to switch from your current NBN provider or are moving house and need a new broadband connection, there are tonnes of NBN deals up for grabs.

Are you a serial downloader? Do you often stream videos in HD? Or are you just tired of your internet lagging in the evenings?

The last 12 months have been a wild ride for many working in the gig economy. Whether you are an established freelancer have recently taken up a side hustle, you’ve likely experienced some major ups and downs over the last year of the increased cost living.

For the fourth year in a row, ING has taken home a major win in the Best Bank category of the Mozo Experts Choice Banking Awards. Huzzah!

You may know PayPal as a digital payment giant, but the company announced its next big step: launching its first-ever rewards credit card in Australia.The move sees PayPal expand its online offering to physical stores, with customers able to take PayPal anywhere worldwide where Visa is accepted. Cardholders can earn points with every eligible purchase and redeem them at any of the 750,000 businesses globally that have PayPal integrated at checkout (including over 300,000 in Australia). The PayPal Rewards Card comes with perks including 50,000 bonus rewards points, uncapped reward points that never expire and zero annual fees. PayPal Australia’s general manager for payments, Andrew Toon, said this flexibility could help credit card users avoid situations where they end up with Frequent Flyer or Velocity points they can’t spend because of COVID-19 border closures. “Customers have said they want a flexible rewards program with points they can redeem however they’d like,” he said.“The pandemic has made the value of flexible rewards even clearer, as many Australians have been left with travel-related points they haven’t been able to use the way they would like to due to safety concerns and border restrictions.”

National Australia Bank (NAB) has increased the interest rates across a number of its fixed home loan terms this morning by between 5 and 10 basis points.

Yes, the Australian property market is currently experiencing a boom. In June, successful sales increased 18% from the previous year. So, it is not surprising that so many Australian homeowners are considering taking advantage of the high housing prices and putting their homes up for sale.

With Sydney once again in lockdown, small businesses in NSW may be one of the hardest hit groups. Restaurants, bars and cafes closed their doors over the weekend as stay-at-home orders were extended across Greater Sydney - and they may remain shut for at least the next two weeks.

The number of Australians seeking a sea or tree change by relocating to the regions has reached a new high during the COVID-19 pandemic according to new research released this morning.

Buying a new home may sound like a daunting task at first, especially with the Australian home market continually on the rise. Whether you are a first time buyer or a seasoned player there are a few must-dos you should follow to make your buying journey easier.

Aussies shouldn’t feel bad for paying for chores their grandparents once did on a day-to-day basis because they’re helping the economy.

As of 1 July 2021, insurance providers subscribed to the Insurance Council of Australia’s Code of Conduct will be providing customers with a year-on-year price comparison in their premium renewal notice.This new change is part of the council’s updated 2020 General Insurance Code of Practice.

Australia’s major banks are offering assistance to customers that have been impacted by the recent COVID-19 lockdown measures in NSW, including short-term deferrals on home loan repayments and fee waivers across a number of products.

Online brokerage platform Stake has announced its intention to offer investors the chance to trade Australian shares and ETFs from later this year.

As part of its 2021/2022 state budget, the NSW government has pledged $200 million to waive stamp duty fees for eligible, new and secondhand zero and low emission cars.

Dreamt of owning a 1963 Mercury Comet ever since you first saw Peyton Sawyer cruise around in one in One Tree Hill? Or maybe a Little Red Corvette’s more your style? Well, now might be the time to turn that dream into reality.

It’s official, Aussie drivers are hitting the road Toyota style! Last week, market research company Roy Morgan announced that Toyota was Australia’s most popular car brand by volume of sales in 2020. “Australia’s largest car manufacturer Toyota has triumphed in the Major Car Manufacturer of the Year Award after winning 12 straight months during 2020,” Roy Morgan chief executive officer, Michele Levine said. “Toyota had an average customer satisfaction rating of 94% during 2020.” On top of that, car insurance provider Budget Direct painted a similar story for the beginning of this year. In fact, according to its latest Australian car sale statistics , Toyota maintained the lead in new car sales with 16,819 vehicles sold over January 2021. This is almost double the amount of the next most popular car brand Mazda, which recorded 8,508 new car sales for the month. Of the Toyota fleet, Budget Direct recorded that the Toyota Hilux was the most popular model with 45,176 new car sales over 2020. This is followed by the Toyota RAV4 (38,357), Toyota Corolla (25,882) and Toyota Prado (18,034). Plus, with the second hand car market currently booming, a bunch of second hand Toyotas have been sold around the country - which are not factored into the above statistics.

Borrowers may soon face higher hurdles when applying for a home loan, as regulators explore potential policy options aimed at cooling down Australia’s white hot property market.Macroprudential controls currently being considered by APRA include tighter debt-to-income and loan-to-value ratios, as well as tougher rules around interest-only and investor lending.The Commonwealth Bank has already revised its assessment rate ahead of any prompting from regulators, bumping it up from 5.1% to 5.25%. More lenders are expected to follow suit.The assessment rate is a serviceability buffer banks use to gauge borrowers’ capacity to repay their loan in the event of a rate hike.Not too long ago, lenders were required to use an assessment rate of at least 7%. But this was amended in July 2019 to better reflect the current interest rate environment. Nowadays, it’s recommended that banks add a margin of at least 2.5% to their home loan rates when assessing applicants, or use an assessment rate of their own — whichever is higher.CommBank now has the highest minimum floor rate of the big four banks. ANZ has the second highest at 5.10%, followed by Westpac at 5.05% and NAB at 4.95%.The decision to tighten standards means some borrowers will have to lower their expectations when applying for a loan, but CommBank says the vast majority of customers will be unaffected.

Launched just last week, new insurance provider Honey is giving qualifying customers up to $250 worth of smart home sensors! The insurtech company which provides home and contents cover aims to use its tech offerings to not only keep Aussies safe, but also help reduce costs for its customers.

You would think that a speedy, affordable internet connection would be a top priority for many these days. Right? Well actually no. In fact, 61% of Australians* Mozo surveyed recently have never switched internet providers!

If you’re prepping your bank account or credit card for a big end of financial year shopping expedition, you’re not alone. A new Mozo study has found 81% of Australians are planning to hunt for discounted computers, software, office furniture and cars before the tax doors close on 30 June.

Founded nearly 50 years ago, Illawarra Credit Union has learned a thing or two about keeping customers happy. And it's this customer-centred approach to banking that helped it win the title of Australia’s Best Credit Union in our 2021 Best Banking Awards.Our team of judges assessed 89 providers on the basis of value and quality. The winners were determined by the number of Mozo Experts Choice Awards they had won over the last 12 months and how their products compared against competitors.Illawarra Credit Union stood out mainly for its home loans, which were recognised in the offset, first home buyer, and packaged home loan categories in 2021. But it also impressed our judges with its personal loan and car loan offers.Since 1972, Illawarra Credit Union has provided a community-oriented banking alternative to the big banks. As a customer-owned credit union, it’s able to invest its profits into improving its products and services, rather than divvying it out to shareholders. We’ve collected an assortment of Illawarra Credit Union products below, but if you’re looking for more information on its win, be sure to read our 2021 Australia's Best Banking methodology report.

Being at an auction in many capitals right now can feel like a poorly run game of musical chairs. Most players will leave empty-handed and quite possibly bruised.This is what happens when people want and need homes, but for whatever reason, the rules of the game favour just a few at the party.Some numbers can help explain how this all works, not least of which are figures showing us what's available.For example, residential property listings around the country dropped in May of this year by 6% to 245,953, down from 262,617 in April, according to SQM Research. That's more than 15,000 fewer properties available to buyers, at a time when there are clearly many people who want a seat in the game.And in a city like Sydney, which garners most of the property headlines, there was a notable drop this May in the number of homes advertised for at least 180 days (4,248), compared to May of 2020 (6,589). SQM says this represents a 36% fall.Are there any new ads for homes going up then?

First home buyers would be able to access grants of up to $25,000 from the state government to assist them with property purchases under a new initiative outlined by New South Wales Treasury.

All in this week’s best banking news recap: editor’s pick.

The past year has seen regional home values grow twice as fast as capital cities, as more and more Australians sought for a sea or tree change, according to CoreLogic. But new figures suggest there may be affordable pockets of Sydney that are even more promising for property investors. According to property developer ALAND, the Greater Western Sydney market could be very profitable for investors, with rental gross yields potentially as high as 4.7% at its Schofield Gardens development in Schofields. For context, rental gross yield refers to your annual rent income divided by the purchase price, so it’s a way to figure out how likely the property will generate a positive cashflow. ALAND said investor returns were lower in popular regional hotspots such as Wollongong, Newcastle and Central Coast. Here are their estimates of rental gross yields in these areas, drawing on data from My Housing Market:

Throughout 2020, drivers in Australia’s five largest capitals (Sydney, Melbourne, Brisbane, Perth and Adelaide) could have saved a combined $485 million by switching from the higher-priced petrol stations to lower-priced major retailers.

The financial impact of COVID-19 on small businesses may be lessening, but new research shows other pressures including cashflow and utility bills have crept up back to pre-pandemic levels. The report from accounting platform MYOB released this week, found that cashflow and the cost of utilities were top concerns for small to medium-sized enterprises (SMEs) over the past six months, felt by 32% of respondents. The bi-annual MYOB Business Monitor also revealed a growing number of SMEs have concerns around accessing business finance (up 6%) and dealing with late customer payments (up 4%). These two money worries saw the biggest jump in percentage points since December last year. Meanwhile, 35% of SMEs said they still feel pressure from the pandemic, but that figure is down 20% compared to the same time last year. The report is based on a survey with more than 1,000 small business owners and operators. MYOB’s general manager for SME, Emma Fawcett said small business issues that temporarily fell off the radar during the pandemic have now returned. “It’s an unfortunate return to ‘business as usual’ for the country’s 2.29 million SMEs with 14 of the 16 business pressures measured by the MYOB Business Monitor increasing in the last six months. This demonstrates that as COVID-19 pressure subsides, other business pressures increase,” she said. “SME concerns with payment times and old bugbears associated with physical presence - such as utilities like electricity and gas - are back on the table.”

Want to dip your toes into the world of share trading but don’t know where to begin?

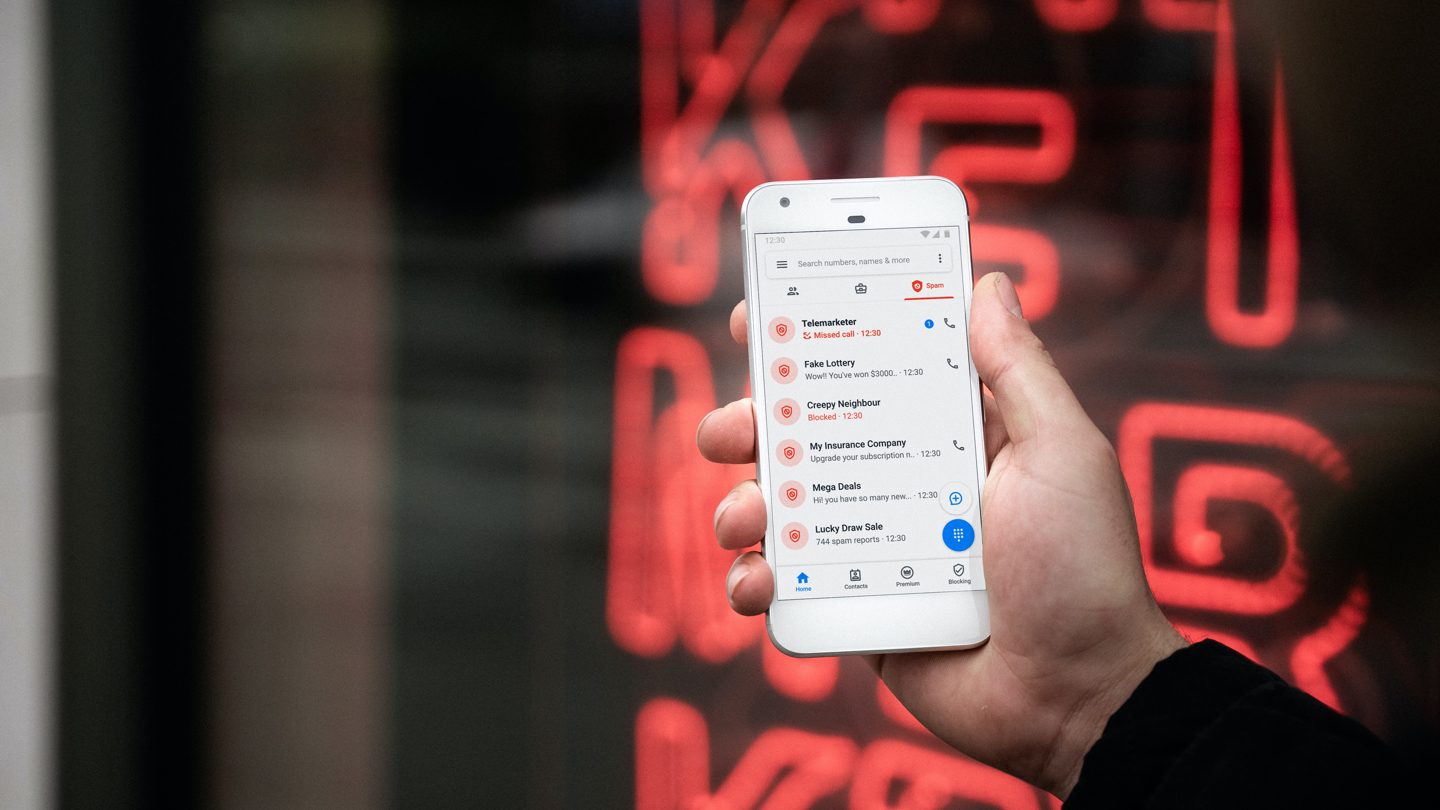

Scammers duped Aussies out of more money in 2020 than ever previously recorded by the Australian Competition and Consumer Competition (ACCC), with a 23% increase on 2019 figures.

Despite these financially tough times, the majority of small businesses are still choosing to navigate their money matters alone instead of turning to professional advice.

The last few years haven’t been great for savers. After six cash rate cuts in 2019 and 2020, interest rates across the board have fallen, including for home loans, savings accounts and of course term deposits.

If your business has cryptocurrency in its investment portfolio, here’s news that might interest you: Australian-based lender FiFit has launched a business loan that lets companies secure funding against their Bitcoin.

The Reserve Bank of Australia offered no surprises at its June policy meeting this afternoon, deciding to keep official interest rates on hold at 0.10 per cent.Consumer and business confidence continues to improve, but Victoria’s return to lockdown is a dismal reminder of how vulnerable the economy is — and will be, until the vaccine rollout gathers pace.Despite the setback, RBA governor Philip Lowe said the Board will be sticking to its forecasts for GDP growth, which were revised upwards last month.“The Bank's central scenario is for GDP to grow by 4¾ per cent over this year and 3½ per cent over 2022. This outlook is supported by fiscal measures and very accommodative financial conditions,” he said.“Progress in reducing unemployment has been faster than expected, with the unemployment rate declining to 5.5 per cent in April.”The parameters of the Term Funding Facility and the government bond purchase program will also remain unchanged, though the TFF is due to be terminated at the end of the month.“At the July meeting the Board will also consider future bond purchases following the completion of the second $100 billion of purchases under the government bond purchase program in September,” said Lowe.Since it cut the cash rate in November last year, the RBA has ruled out an increase until the labour market improves and inflation is within 2 to 3 per cent. It doesn’t expect this target to be met until 2024 at the earliest.In stark contrast, the Reserve Bank of New Zealand recently surprised market pundits by announcing its next rate hike could come as early as the second half of 2022.Central bankers in the UK, US and Canada have hinted at similar moves, leading some to believe that inflationary pressures will force the RBA to tighten monetary policy sooner than planned.

Winter’s finally here and so too are the colder days and longer nights. For many of us that means taking life at a slower pace and indulging in the pleasures of food and warmth that come indoors.

Well, we’ve officially reached the halfway mark of the year. Not to mention, with winter well and truly here and the new financial year right around the corner, we’re in for one jam-packed month ahead.

New car smell can be enticing, but there’s nothing quite like a bargain secondhand vehicle. But, as always, it’s best to proceed with buyer caution.